Aspects of Wealth Creation

Wealth creating companies have substantially high RoE (Return on Equity) and RoCE (Return on Capital Employed). There is also a high correlation between RoE and P/E.

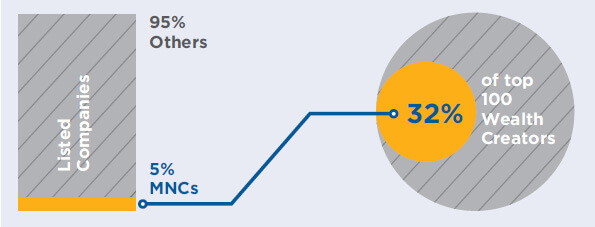

- In an era of nascent equity markets, MNCs enjoy high traction with investors. Thus, over 1991-96, MNCs were only 5% of total listed companies, but accounted for 32% of top 100 wealth creators during the period.”

- Businesses with high entry barriers (e.g. arising out of proprietary knowledge in technology/marketing such as in pharmaceuticals) are more likely to feature among top wealth creators.

- Focused companies are more likely to create sustained wealth, rather than diversified companies.

- Mid-cap stocks have the propensity to create wealth faster than heavyweight blue chips but the surety of wealth creation is greater for large caps.

- Right judgment of long-term sustainability, prosperity of business, and responsible management play a crucial role in identifying wealth creators.

- Wealth creation occurs when a great management runs a great business. But if an outsider were to buy into such great businesses through the stock market, he/she must enter at the right price to earn substantial appreciation.

Hero Motocorp

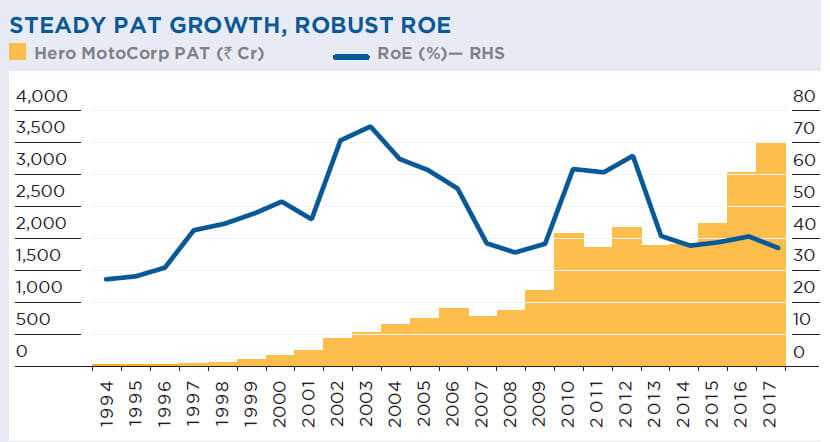

- Hero MotoCorp (earlier known as Hero Honda) is one of Motilal Oswal’s earliest QGLP ideas, and a classic example of how “Wealth creation occurs when a great management runs a great business.”

- Quality

#1 – Great management Hero MotoCorp started off in the mid-1980s as a JV between Honda, the world’s No.1 twowheeler company and Hero Group, the largest manufacturer of bicycles in India. - #2 - Great business In India, two-wheelers is a great business given (1) the huge size of opportunity, and (2) limited competition. In a developing economy, a two-wheeler is the entrylevel vehicle for motorised personal transportation. The opportunity is enormous, both in India and globally. India has a large population with an aspiring middle class, which helps create a huge market for two-wheelers. Even outside India, unlike cars, not many companies make two-wheelers. Also, the business enjoys negative working capital thanks to on-cash sales coupled with outsourcing of components.

- Growth Hero Honda was the first company to launch the fuelefficient 4-stroke motorcycle in India, which was then a predominantly scooter-driven market. In fact, Hero Honda spearheaded the whole value migration within Indian twowheeler market from scooters to motorcycles. It is today India’s largest two-wheeler company by far.

- Longevity

A motorcycle typically has an average life of about 10 years. Hence, there is an attractive replacement opportunity as well. Longevity of the business is almost assured. - Price

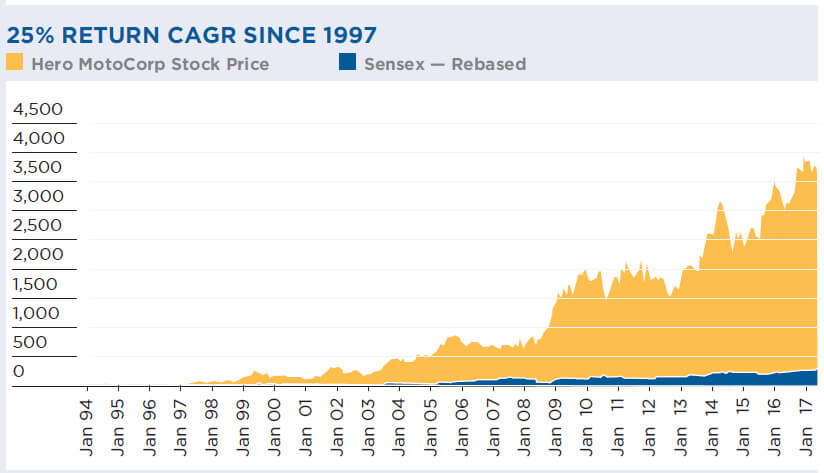

The Indian two-wheeler opportunity could be bought at less than ` 1,000 crores in mid1997. Since then, the stock has compounded 25% every year for 21 years to-date v/s 12% for the Sensex.

Laying the Foundation

- Looking back, the very first wealth creation study covered all 4 pillars of our QGLP Investment Philosophy.

- One of the key highlights of the study is - “Right judgment of long-term sustainability, prosperity of business, and responsible management play a crucial role in identifying wealth creators.” This essentially covers Q(uality), G(rowth) and L(ongevity).

- MNCs and businesses with high entry barriers were prominent wealth creators even during the first study, suggesting the importance of quality – both of business and of management.

- A business can be called ‘great’ when it combines Quality, Growth and Longevity. Having identified such great businesses, investors then need to ensure that they buy the stocks at the right P(rice).

- The final highlight of the study puts it all together – “Wealth creation occurs when a great management runs a great business. But, for an outsider to buy into such great businesses through the stock market, he/she must enter at the right price to earn substantial appreciation.”

- Finally, the essence of the first study also confirms that Quality does not necessarily come cheap. “There is also a high correlation between RoE (i.e. representing Quality) and P/E (i.e. representing Price).”

- It is only when all of QGLP is understood and practised in a disciplined manner that sustained wealth can be created in equity investing.