Good Businesses Which Get Better

Improving RoE on a sustained basis is the key to wealth creation. For this to happen, “The principle one must bear in mind while identifying a right business is that the business economics must not only be distinctly superior, but should get better with time.”

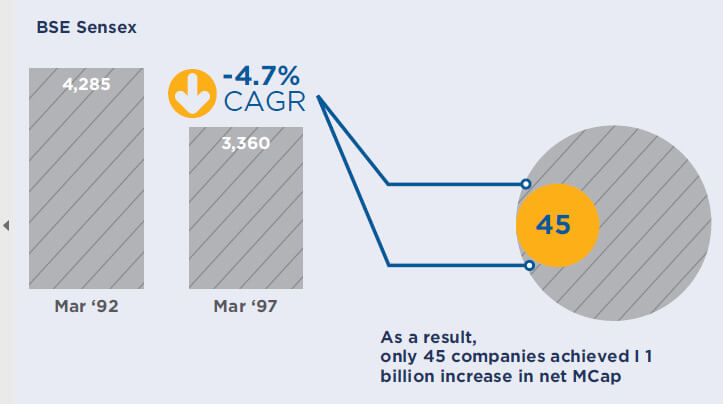

- Over the study period (Mar92 to Mar-97), BSE Sensex declined from 4,285 to 3,360, i.e. return CAGR of -4.7%. As a result, only 45 companies managed to achieve the wealth creation threshold of ` 1 billion increase in net market cap. Hence, it is often said, “Wealth creation in a falling market is like swimming against the tide, not impossible but difficult.”

- Going by the Du Pont model, RoE is a product of three key ratios: (1) Net Profit to Sales (PAT Margin); (2) Sales to Assets (Asset Turnover); and (3) Asset to Equity (Gearing). Wealth creators tend to exhibit rising PAT margin, stable asset turnover and a falling gearing (i.e. funding expansions through internal accruals).

- RoCE of wealth creators tends to be substantially higher than the prevailing coupon rate. Their RoCE starts high and heads north with time. Average RoCE of wealth creators moved up from 20.4% in 1992 to 24.5% in 1996.

- Most wealth creators enjoy a dominant market position in their respective businesses. In the 1992-97 study, two-thirds of the wealth creators were No. 1 or No. 2 player in their segments.

Nestlé

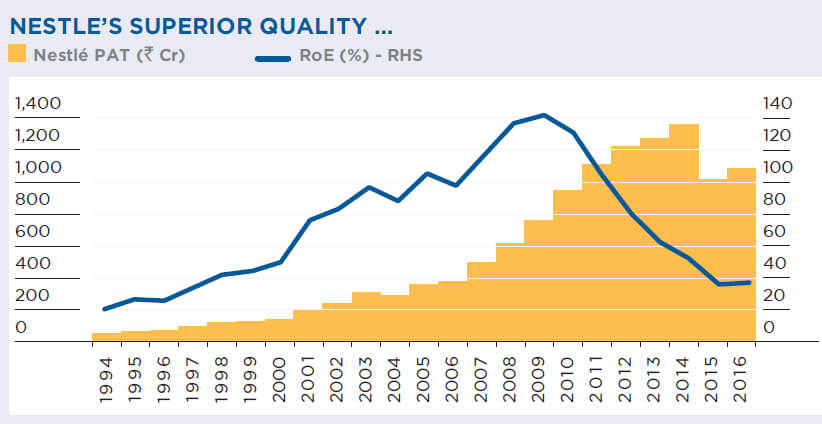

- Nestle is an excellent case of improving RoE on a sustained basis for wealth creation

- Over 14 years between 1996 and 2010, Nestle’s RoE improved from 22% to over 120%. It has corrected in the last four years due to a massive capex programme combined with the Maggi fiasco. Yet the company’s Dec-2016 RoE is healthy at 32%.

- Dec-16 PAT at Rs. 946 crores is 18 times the 1996 PAT of Rs. 53 crores.

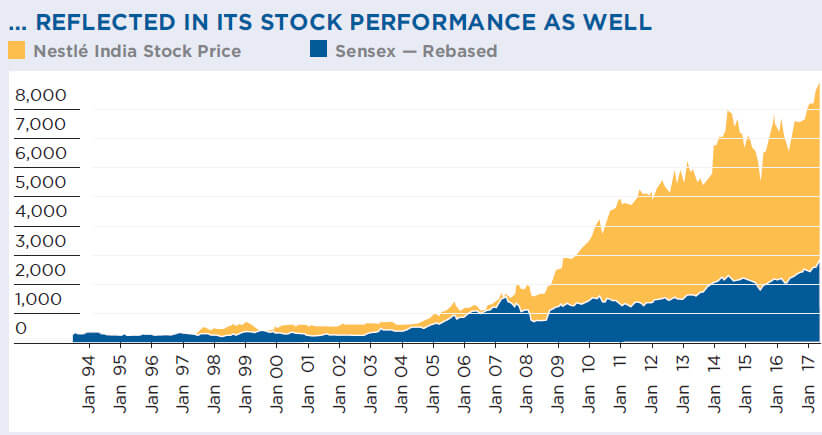

- Sure enough, the stock has delivered 18% compounded return over the last 20 years versus only 12% for the Sensex.

The Nestlé stock delivered 18% CAGR over 20 years proving rising RoE leads to sustained wealth creation.

Quality First

- The 1992-97 study was conducted amidst a stock market slowdown, (-5% return CAGR of BSE Sensex, in sharp contrast to the 23% CAGR over first study period of 1991-96).

- It is in a downturn that the Q(uality) of QGLP matters the most. Nearly half of the 45 wealth creators were MNCs, suggesting that the equity markets too adopted a quality first strategy.

- Two-thirds of the wealth creators were No. 1 or No. 2 players in their respective markets, reinforcing the fact that Quality remains one of the key strengths of wealth creators.

- Subtly, the study also captured the critical connect between Quality and Longevity. Essentially, it said, “A right business is one where the business economics is not only distinctly superior, but gets better with time.” This getting better with time is what Quality and Longevity is all about.

- 69% of the wealth creators were blue chips, up from 40% in the first study. In contrast, fast growers and turnarounds were down to 29% (53% in the first study).

- During economic downturns, G(rowth) gets downplayed. Investors know that businesses go through cycles. A ‘Quality-driven’ business will survive the downturn with modest growth, but bounce back strongly once the situation improves. Hence, during economic slowdown, MNCs and companies with strong franchises enjoy investor traction, despite being richly valued.