Competitive Strengths of Wealth Creators

Successful investment in equities calls for:

| 1. | Identifying the right business, |

| 2. | Which is run by a competent management, and |

| 3. | Is acquired at a price, which is at a huge discount to its underlying value. |

- The study period (Mar-93 to Mar-98) saw the emergence of IT as a wealth creating sector for the first time, accounting for 5% of the wealth created.

- Way back in 1998 itself, the

study made three significant

predictions:

- The widespread usage of IT in the years to come and India’s competitive advantage in this sector would provide exciting growth opportunities.

- As Indian industries face up to global integration, some businesses, such as pharmaceuticals would benefit significantly from an improvement in their business economics.

- The age and income profile of the Indian population and its irreversible nature can trigger a huge revolution in the consumer goods sector. Businesses built upon strong consumer visibility could hence flourish.

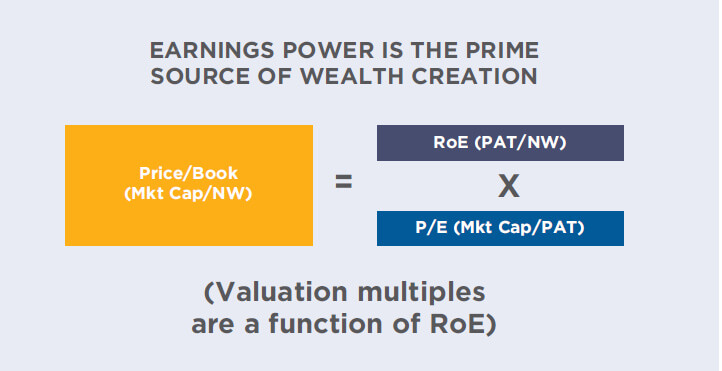

- Earnings power is the prime source of wealth creation. Arithmetically, Price/Book (Mkt Cap/NW) = RoE (PAT/ NW) x P/E (Mkt Cap/PAT). Thus, valuation multiples are clearly a function of RoE.

Infosys

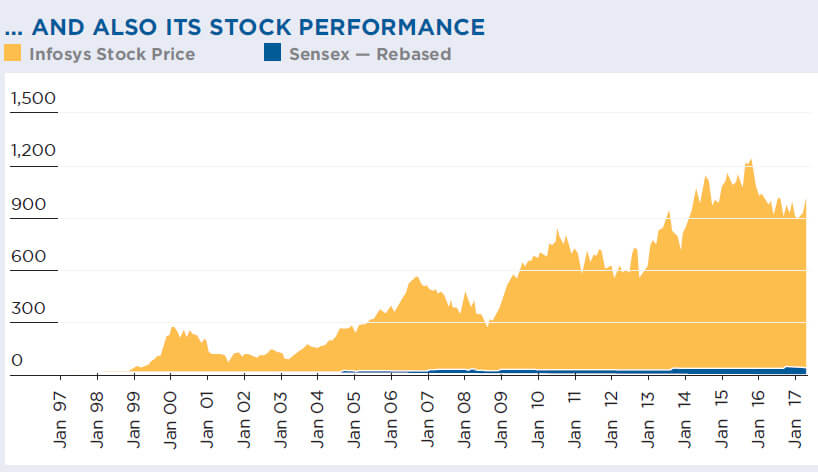

- Back in 1998, Infosys clearly embodied the essence of “(1) Identifying the right business (2) Which is run by a competent management, and (3) Is acquired at a price, which is at a huge discount to its underlying value.”

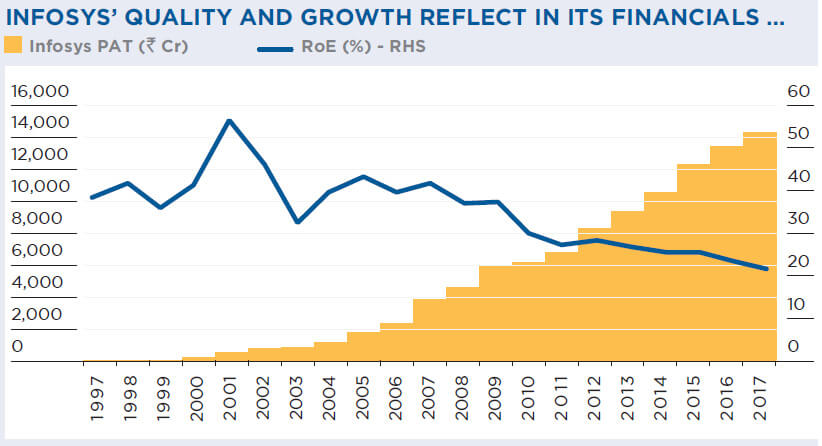

- Its PAT has grown handsomely, its P/E had climbed to over 200x, and the stock has delivered compounded annual returns of over 26% for the last 20 years v/s only 12% for the Sensex.

Substantial growth in Infosys’ PAT translated into a P/E which rose to over 200x and a stock price that delivered CAGR of over 26% for the last 20 years.

The Quality-Price math, the non-quality aftermath

- Even as markets remain obsessed with G(rowth), Wealth Creation studies never failed to emphasise the importance of Q(uality).

- The 1998 study argued, “Predictability and growth in earnings is insufficient in itself. A company must earn stable or consistently higher returns on shareholder capital (i.e. ROE).”

- The Quality-Price math (Price/Book = RoE x P/E) makes it clear what investors need to look for – “What is therefore paramount for any investor is to visualise or forecast accurately a corporation’s future RoE stream. Businesses which offer greater certainty in projecting its emerging stream of RoE are inherently less riskier and more valuable.”

- Even as investors focus on what to buy, they need to equally know what to avoid. Thus, “Wealth-destroying companies tend to be asset-intensive businesses with negligible focus on intellectual capital.” They are also typically “highly-fragmented, lowentry barrier businesses that provide undifferentiated products or services.” (Interestingly, the 2008 study had a term to describe such businesses – Gruesome – of the triad of Great, Good and Gruesome).