How to Value Growth

High earnings growth firms with high RoE, bought at a reasonable PEG (PE/Earnings Growth ratio), create maximum wealth.

- Earnings growth and earning power are the key drivers to wealth creation.

- The value of any company depends primarily on three factors:

- Current profit,

- Current capital employed,

- Future growth in profits and profitability.

- Consistency, profitability and sustainability are the key drivers to the valuation of growth.

- Consistency: Secular or consistent growth commands much higher valuations than cyclical growth as it is more predictable.

- Profitability: For growth to become self-financing and capable of generating free cash flows, it must be profitable.

- Sustainability: Value of companies depends considerably on the perceived longevity of their earnings growth.

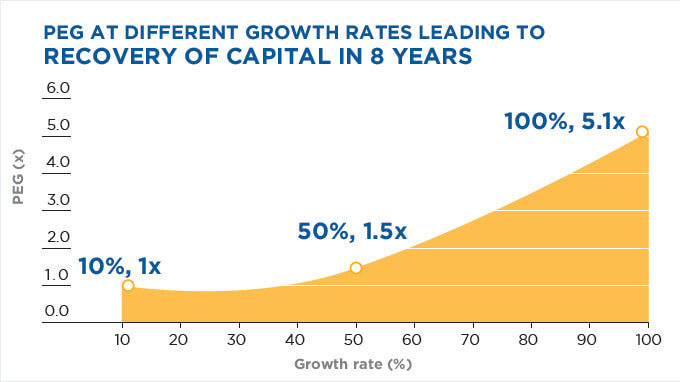

- One valuation ratio, which captures growth is PEG (P/E to Earnings growth). The appropriate PEG for any stock depends on the underlying growth rate itself. Thus, EPS growth of 10%, when bought at PEG of 1x leads to recovery of initial capital in 8 years. But if EPS growth is 50%, then even a high PEG of 1.48x (i.e. purchase P/E of 74x) leads to capital recovery in the same 8 years.

Shriram Transport Finance

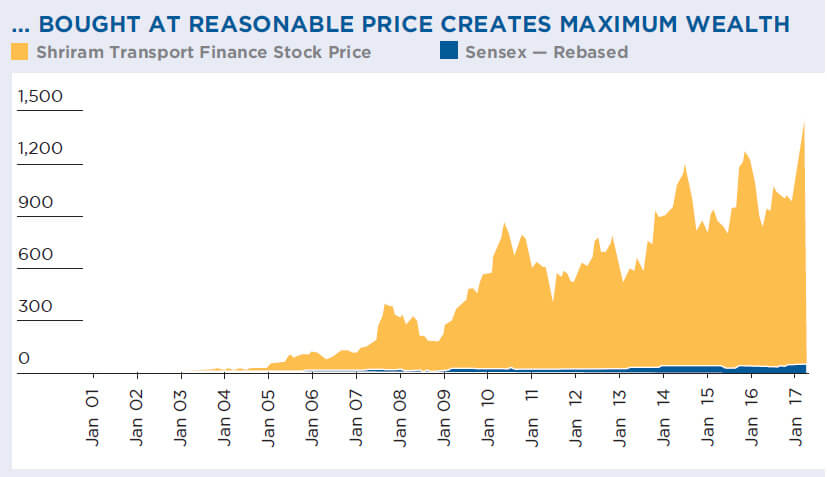

- Shriram Transport Finance captures the essence of the study, “High earnings growth firms with high RoE, bought at a reasonable PEG (PE/Earnings Growth ratio), create maximum wealth.”

- For the year ending March 2001, Shriram had an RoE of 25%, which is very healthy in the financial sector. In March 2001, the stock was available at a P/E of just 1x; thus PEG was very low. True to form (and the high-growth-high-RoElow-PEG formula), the Shriram Transport stock delivered return CAGR of a whopping 85% over the next 5 years. Over the last 12 years, the stock has delivered 24% return CAGR v/s 12% for the Sensex.

An example of a high-growth-high-RoElow-PEG company, Shriram Transport stock delivered a CAGR of 85% between 2001 and 2005, and 24% between 2005 and 2017.

PEG-ged to Growth!

- Nine of the top 10 fastest wealth creators during 1994-99 were IT companies. Of the top 100 wealth creators, 20 were IT companies (vis-àvis five during the 1993-98 period).

- This staggering stock performance of IT companies during 1994-99 reinforced the focus on earnings growth as a key driver of wealth creation.

- The concept of PEG connects Growth with Price. The rising PEG curve establishes that one can pay somewhat higher price for growth, and still end up creating significant wealth.