Management Integrity: Understanding Sharp Practices

Essence

In equity investing, management is 90%, industry 9% and 1% everything else. Hence, getting Management Integrity right is the critical first step.

- There’s only one way of writing honest accounts, and infinite ways of manipulating them.

- Most Sharp Practices are to inflate profits and stuff the ¡§financial trash¡¨ in the Balance Sheet (Credit P&L, Debit Balance Sheet).

- Profit & Loss statement is easier to manipulate; hence, managements must be statutorily asked to present a simplified Free Cash Flow statement.

- Auditors must be made more accountable to minority shareholders to avoid Sharp Practices by the management.

- As an investor, have a forensic mindset to get management’s explanation for all the perceived Sharp Practices.

- Finally, interact with various stakeholders - customers, employees, suppliers, competitors, etc - till you arrive at a moment of Management Integrity.

- Why study Management Integrity?: There’s enough evidence to know that when investors get stuck with companies where Management Integrity comes under question, it’s literally a race to zero! Hence, this study looks into a few key aspects related to management integrity e.g.

- The motivations behind compromised integrity,

- The quantitative signals of suspect Management Integrity with relevant examples, and

- Finally, a few Indian case studies where Management Integrity was seemingly compromised.

- What is Management Integrity: for the purpose of equity investing, Management Integrity can be defined as dealing with all company stakeholders honestly and with a sense of trusteeship. Stakeholders comprise of employees, customers, suppliers, shareholders, government, and the community at large.

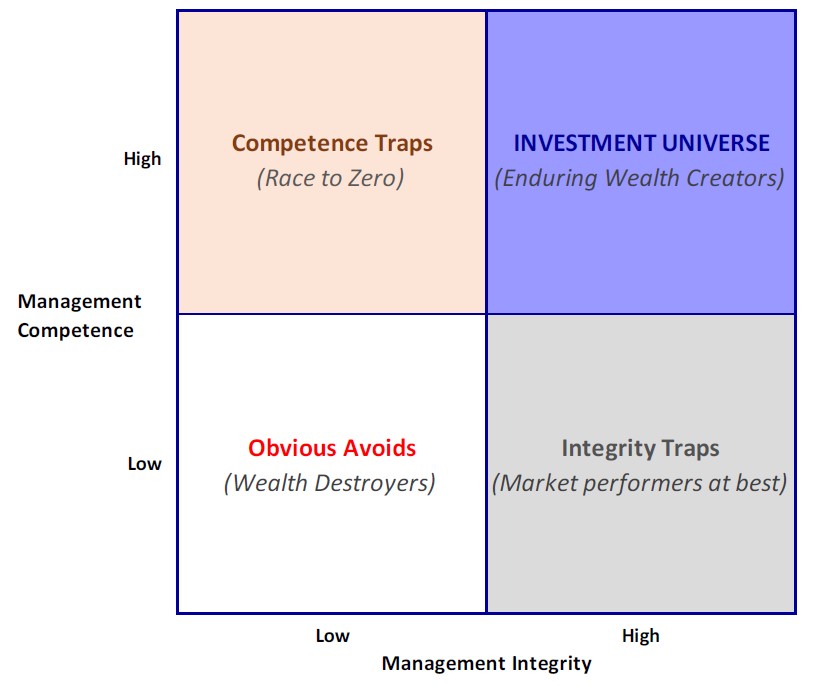

- Why Management Integrity is critical: Maintaining high level of integrity is hugely beneficial for all stakeholders including the owners and senior management, as the market rewards them by way of premium valuations. The grid below clearly suggests that only those companies with both Management Integrity and Management Competence should form part of the investment universe.

- What are Sharp Practices?: When Management Integrity is compromised it uses all tricks in the trade to present a rosy picture of its affairs when in fact it isn’t. It does this by resorting to what are called Sharp Practices. Sharp Practices may be defined as “ways of behaving, especially in business, that are dishonest but not illegal.” There are two major kinds of Sharp Practices by companies with compromised management integrity

- Accounting related and

- Non-accounting related.

- Accounting Sharp Practices: There are two broad categories of accounting Sharp Practices in the non-financials sectors –

- Earnings manipulation and

- Cash Flow manipulation. Some common sharp practices here are:

- Recording bogus revenue by inflating debtors

- Shifting current expenses to a future date e.g.

- providing lower depreciation on fixed assets and

- capitalzing revenue expenses such as R&D spend.

- Recording revenue too soon e.g. construction companies may book revenue before getting clients’ approval on the work done

- Boosting income through one-time activities such as sale of land or other assets

- Sharp Practices during acquisitions such as overvaluation of assets acquired.

- Off-balance sheet Sharp Practices such as standing guarantee for loans by group companies.

- Non-accounting Sharp Practices: These include related party transactions and misleading earnings guidance.

- Financial sector Sharp Practices: These include upfronting of income and postponing of expenses, and not fully recognizing bad assets.

- Other checks on Management Integrity: Besides keeping an eye on the management’s Sharp Practices, investors would do well to keep a tab on auditors’ report, top management changes, promoters’ pledged shares, and also take a 360-degree feedback on Management Integrity from non-executive Board members, current/ex employees, customers, distributors/dealers, suppliers and competitors.

Manpasand Beverages

Company & Promoter background

- Manpasand Beverages is a fruit drink manufacturing company engaged in processing, manufacturing and marketing of juice from fruit pulp. It offers its products under the brand names Mango Sip, Apple Sip, Guava Sip and Litchi Sip.

- The company was founded in 1997 and is based in Vadodara, Gujarat

- Mr Dhirendra Hansraj Singh is the Chairman and Managing Director and holds a Bachelor's Degree in Arts from Gorakhpur Vishwavidyalaya, Varanasi.

The Sharp Practice modus operandi

- The company is alleged to have overstated its revenues and profits.*

- The company set up 30 fake units across the country. Purchase and sale transactions were then shown with values inflating with each transaction in order to claim a cumulatively large sum of input credit.**

- These inter-unit transactions were worth over INR 3 billion and their input tax credit would come up to INR 0.4 billion.**

The red flags & the bust

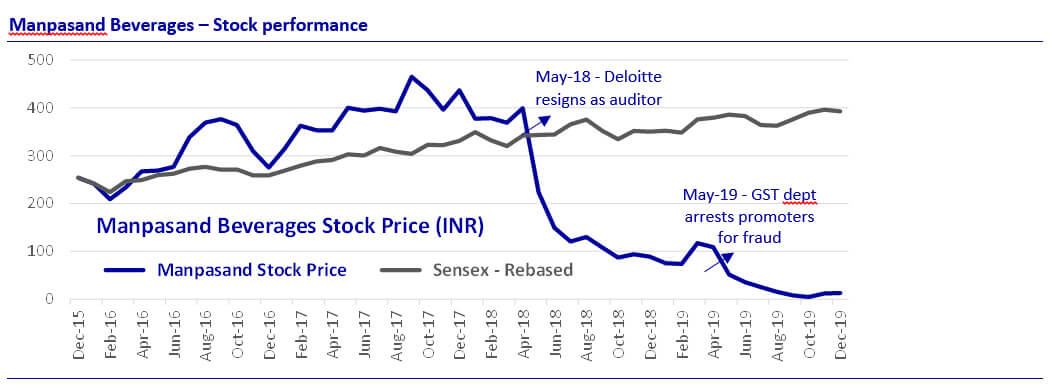

- Incongruence in market share data, too-good-to-be-true growth and industry-leading margins were the red flags prior to the auditors resigning in May 2018.

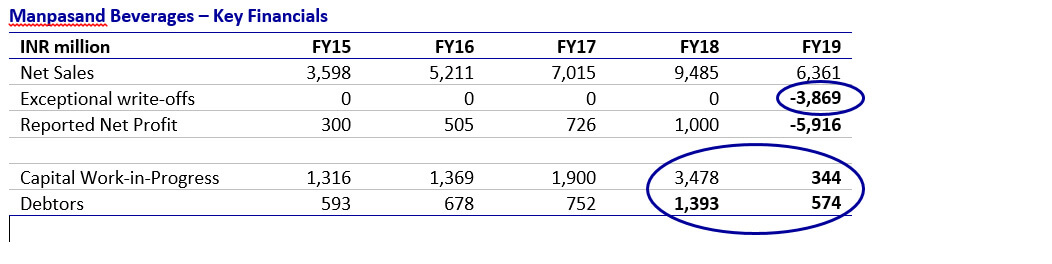

- In FY19, the company wrote down its sales and receivables by issuing a credit note of INR 1.8 billion, and providing for a credit loss of INR 1.2 billion on its receivables.

- To divert funds, capital work in progress and capital advances seem to be inflated as well. An amount of INR 2.7 billion has been provisioned for losses in FY19.

- The promoters were jailed for GST fraud in May 2019. The company has deposited INR 178 million with the GST authorities under protest to secure their release.

Sources:

* Business Today, 9-Oct-19 – “Is Manpasand Beverages among the biggest corporate frauds in India?”

Money Control, 31-May-19 – “How a Rs 40-crore GST fraud unfolded at Manpasand Beverages”

- The 24th Wealth Creation Study is dedicated to Quality of Management.

- The key takeaway from the study is captured by Thomas W. Phelps who says in his classic 100 to 1 In The Stock Market, “The best defense against fraudsters is to run away from them as fast as possible at the first hint of sharp practice. With more than 50,000 different stocks available to investors in this country, it is not only unnecessary but downright stupid to buy into a company run by men of doubtful integrity.”