Mid-to-Mega: The Power of Leadership in Wealth Creation

Midcaps which are market leaders in their business have a good probability to emerge as large caps and generate handsome returns in the process.

- Definitions We classify stocks as Mega, Mid and Mini based on market cap ranks. Mega are the top 100 stocks, Mid the next 200 and Mini all others.

- What is Mid-to-Mega Mid-toMega stands for a company’s stock crossing over from the Mid (i.e. ranks 101 to 300) to the Mega category (i.e. top 100).

- Why Mid-to-Mega There are 3 crossovers relevant to the buyers of stocks – (1) Mini-toMega, (2) Mini-to-Mid and (3) Mid-to-Mega. Data suggests that of the 3, Mid-toMega is the most profitable in terms of risk-adjusted returns, and most plausible in terms of associated probability.

- What it takes to achieve Mid-to-Mega “Lollapalooza effect” is a term popularized by Charlie Munger, partner of Warren Buffett in Berkshire Hathaway. It stands for really big outcomes arising from multiple factors acting together. We believe Mid-toMega is one such lollapalooza effect of MQGLP – Mid-size (of company), Quality (of business and management), Growth (in earnings), Longevity (of both quality & growth) and Price (favorable valuation).

- Industry leadership The most striking feature emerging from this study is the key role of industry leadership in the pecking order of market cap ranks. Thus, in December 2015, among the top 100 companies by market cap, as many as 88 were leaders in their respective industries. Even among the companies that moved from Mid-to-Mega in recent years, about 70% are industry leaders.

Britannia Industries

- M (Mid-size): In FY12, the company’s sales were about ` 3,800 crores as was its market cap

- Q (Quality of business & management): Biscuits, bread, cakes and dairy products are consumer-facing, steady state businesses. There is steady value migrating from the unorganized sector to the organized sector. The competitive landscape is fairly favourable with only 3 major players – ritannia, Parle and ITC. There was a change in management with Varun Berry replacing Vinita Bali as the CEO.

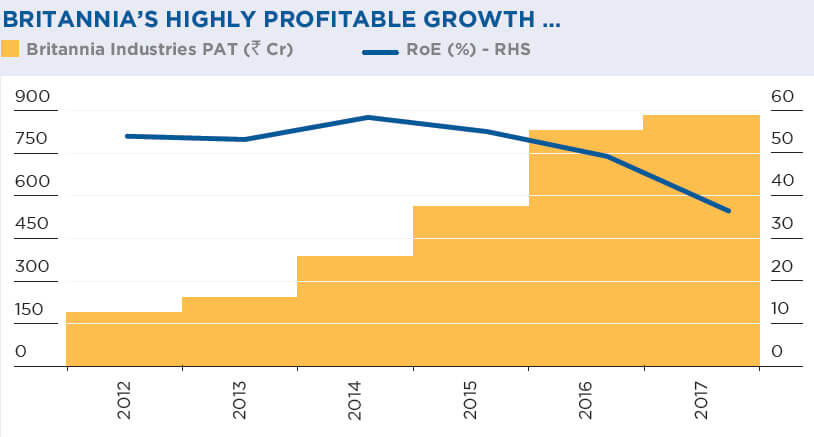

- G (Growth in earnings): FY10-15, on a sales CAGR of 16%, Britannia clocked PAT CAGR of 36% as the new management actively slashed operating and general overheads. EBITDA Margin more than trebled from 3.5% in FY10 to 10.8% in FY15, and RoE jumped from an already healthy 24% to a high 55%.

- L (Longevity): Britannia’s products will remain relevant to consumers for a long time to come.

- P (Price): As of Mar-2010, Britannia’s P/E seemed rich at 31x trailing. However, it was reasonable considering its healthy RoE (24%), handsome dividend payout (49%), and the growth prospects.

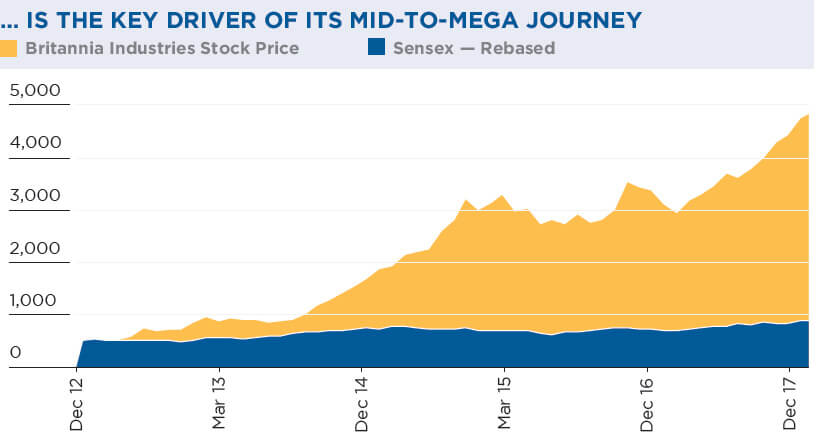

Britannia Industries is a classic Mid-to-Mega case. Its rose market cap rank from 211 in FY2010 (Mid) to 82 in FY15 (Mega). It captures all the elements of MQGLP with Leadership inside.

The “M” prefix

- The 19th Wealth Creation Study outlined the framework for achieving 100x in equity investing —SQGLP i.e. the timetested principles of QGLP prefixed with S, which stands for small Size.

- Likewise, the 20th Study’s framework for Mid-to-Mega is MQGLP with industry leadership inside (akin to Intel inside).

- All mid-size companies which pass the QGLP litmus test and enjoy leadership in their respective businesses are potential Mid-to-Mega stocks.