CAP & GAP: The Power of Longevity in Wealth Creation

To earn high long-term returns in equities, two key questions need to be answered regarding the companies invested in: (1) Whether – and how long – will the company survive? And (2) How long will it profitably grow?

- There are two dimensions of a company’s Longevity - (1) Longevity of competitive advantage (popularized by Warren Buffett as “Economic Moat” or simply “Moat”); and (2) Longevity of a company’s earnings growth

- What is CAP?: Competitive Advantage Period (CAP) is the time during which a company generates returns on investment that exceed its cost of capital. In effect, CAP is a measure of longevity of a company’s Moat

- Factors determining CAP: There are two major factors which determine CAP - (1) Attractiveness of industry structure and (2) Effectiveness of a company’s own strategy.

- Inter-firm rivalry: Higher the inter-firm rivalry lower the attractiveness and vice-versa

- Bargaining power of customers: Higher the bargaining power of customers, lower the attractiveness and vice-versa

- Bargaining power of suppliers: Higher the bargaining power of suppliers, lower the attractiveness and vice-versa

- Threat of new entrants: Higher the bargaining threat of new entrants, lower the attractiveness and vice-versa

- Threat of substitutes: Higher the bargaining threat of substitutes, lower the attractiveness and vice-versa

- On company strategy, according to Michael Porter, there are 3 broad strategies - (1) Differentiation, (2) Low cost, and (3) Focus.

- Differentiation: A differentiated strategy is all about offering customers a unique value proposition which is not easy to replicate by competition.

- Low cost:When products/services are homogenous, having the lowest cost compared to peers is the only way to sustain competitive advantage.

- Focus: This is a special case of companies focused on just one segment of product, customers or geography i.e. a niche

- What is GAP?: Growth Advantage Period (GAP) is the time during which a company grows its profits at a faster rate than that of the benchmark indices. Pace of earnings growth in a company is typically highest during its GAP. As stock returns are correlated with earnings growth, it is logical that stocks outperform the benchmark during their GAP.

- Factors determining GAP: (1) CAP (2) Industry growth (3) Company Growth Mindset.

- CAP: In most cases, CAP is the foundation for sustained GAP.

- Industry growth: Determinants of Industry growth situations include: economic growth, value migration (from inferior business design to superior one), low market penetration, favourable regulatory changes, etc.

- Company Growth Mindset: There are two types of mindset: (1) Fixed mindset and (2) Growth mindset. Unlike people with fixed mindset, those with growth mindset see failure not as evidence of unintelligence but as an opportunity for growth and for stretching existing abilities. Companies with growth mindset tend to be more entrepreneurial in nature.

- Characteristics of CAP-cumGAP companies: Quantifying the determinants of CAP and GAP, and applying the same to Indian companies led to identifying three key characteristics of CAP-cumGAP companies – (1) Clear strategy, (2) High Growth Mindset, and (3) High-growth industry situations.

The Five Forces framework of Michael Porter is ideal to assess the attractiveness of industry structure:

Porter uses “Stuck-in-the-middle” to describe companies which do not seem to have adopted any of the above strategies.

Companies with favourable Industry Structure and favourable strategy tend to enjoy the longest CAP.

Maruti Suzuki

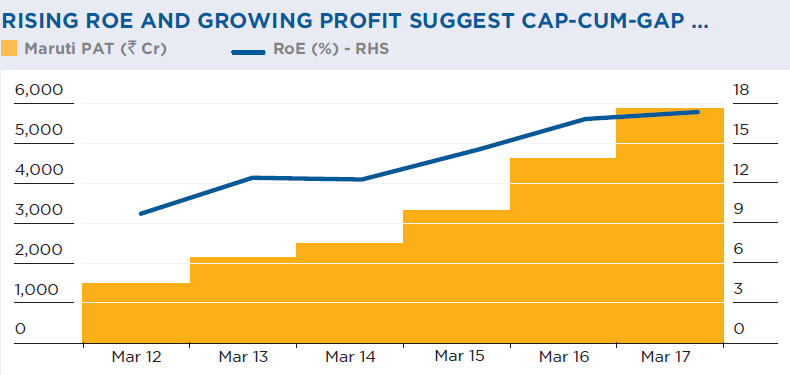

Maruti Suzuki is a classic CAPcum-GAP company.

- It enjoys strong brand equity in the Indian car market. Its market share is over 50% and rising i.e. it has a high CAP.

- India’s underlying economic growth and rising per capita incomes ensures that car demand will remain high for a long time to come.

- Maruti has already tied up with Toyota for electric vehicles as and when they pick up. Thus, Maruti enjoys a high GAP as well.

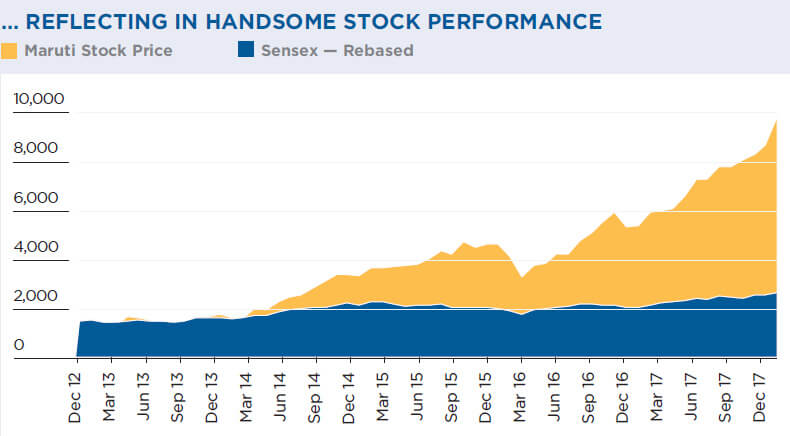

- Maruti’s high CAP-cumGAP is reflected in its stock performance – return CAGR of 46% over the last 5 years versus 12% for the Sensex.

Dedicated to Longevity

- The 22nd Wealth Creation Study is the first one dedicated exclusively to Longevity.

- CAP measures Longevity of Quality (L of Q) and GAP measures Longevity of Growth (L of G).

- Investing in CAP-cum-GAP companies is a certain source of long-term Wealth Creation.