Essence

- Value migration from Atoms to Bits is inevitable.

- India is at the cusp of harnessing digital potential.

- Buy into sure winners in digital, successful digital transformers and classical Indian IT companies.

Consistents & Volatiles – The two dimensions of Wealth Creation

Defining Consistents & Volatiles

Our definitions make the abstract concepts of Consistency and Volatility concrete by backing them up with some math. (For ease of use, we call the consistent companies as “Consistents” and the volatile companies as “Volatiles”.)

For a company to be deemed a Consistent, it should meet the following 3 criteria –

- Over a 15-year period, its annual PAT should not fall by over 10% more than thrice (twice if the period is 10 years);

- No fall in PAT should be greater than 50%; and

- The terminal year PAT should not be lower than the initial year PAT.

All companies that are not Consistents are Volatiles. This way, the entire corporate sector can be divided into just two categories of companies – Consistents and Volatiles.

Sources of Consistency & Volatility

Whether a company is Consistent or Volatile is influenced by a wide range of industry-level and company-specific factors.

Industry-level factors

The important industry-level factors influencing Consistents and Volatiles are –

- Nature of demand

- Competitive landscape

- Value inflow/outflow and

- Government regulation.

Company-specific factors

The important company-specific factors influencing Consistents and Volatiles are –

- Company strategy and execution

- Industry leadership

- Pricing power

- Capital (mis)allocation.

Analyzing the numbers behind the narratives

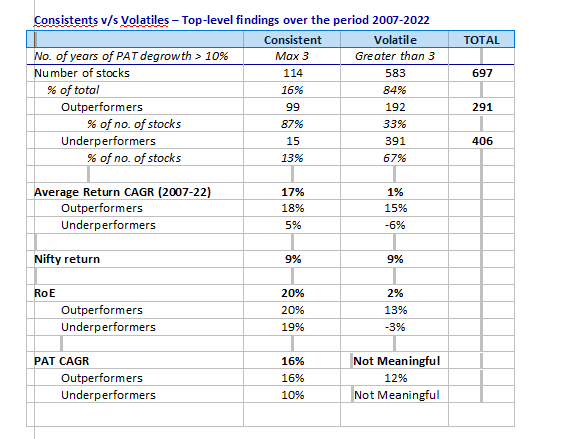

We analysed about 700 companies listed throughout the last 15 years i.e. 2007 to 2022. Our top-level findings are tabled below.

Key Takeaways -

- A very high 87% of Consistents have outperformed the benchmark. That figure is 33% in the case of Volatiles.

- The average 15-year return of Consistents is a high 17% as compared to 1% for Volatiles. (Benchmark Nifty return during this period is 9%.)

- There are outperformers in both the categories. However, Consistent outperformers have delivered an average 18% return CAGR v/s 15% for Volatile outperformers.

- A portfolio of Consistent companies is likely to have robust average RoE (20% in the above case) and PAT CAGR (16% in the above case).

Reconfirming the findings

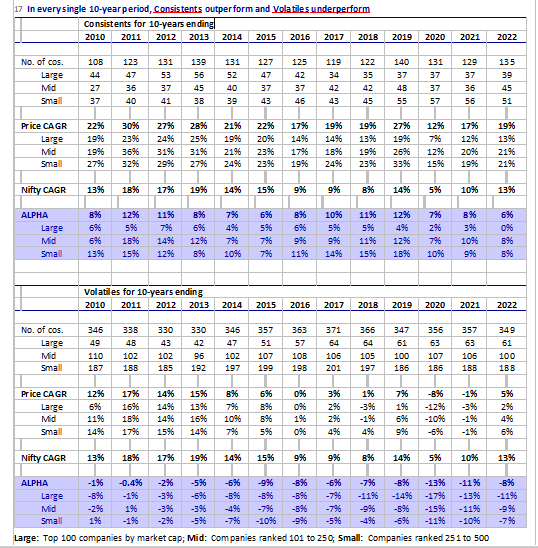

We wished to reconfirm the above data over different time series. So, we repeated the exercise for the respective top 500 companies over 13 rolling 10-year periods from 2000 to 2022. The results staggered us. In every single 10-year period, Consistents as a group outperformed the benchmark, and in every single 10-year period, Volatiles underperformed the benchmark (tabled below). Even more staggering is that the outperformance-underperformance phenomenon holds true across market cap categories – large, mid and small.

How to create wealth from Consistents & Volatiles

There are two elements of Wealth Creation using equity stocks – (1) Entry strategy and (2) Exit strategy. The entry strategy for Consistents is to buy below median P/E (Price-to-Earnings ratio), and for Volatiles, it is to buy below median P/B (Price-to-Book ratio). As regards the exit strategy, it is possible to practice “Buy-and-Hold” in the case of Consistents. However, Volatiles must be sold at an appropriate price, typically significantly higher than median P/B. Failing to do this can lead to prolonged no or low return.

Conclusions

- This makes the practitioner’s job significantly easy. Having bucketed a stock as either Consistent or Volatile, the next major steps are clear –

- For Consistents –

- Determine whether it is likely to remain Consistent over the next 3 years at least

- If yes, check whether its current P/E is below its long-period median

- If yes, Buy.

- For Volatiles –

- Determine whether it is likely to hit a Consistency Patch over the next 3 years

- If yes, check whether its current P/B is below its long-period median

- If yes, Buy.

- Consistency is the source of Outperformance; Volatility is the source of Under-performance

- Consistents outperform only as long as they remain Consistent; they underperform if they turn Volatile.

- Likewise, even Volatiles outperform when they hit a Consistency Patch.

- Excellence in execution is non-negotiable for Consistency

- As seen earlier, there are cases of Consistents even in Volatile sectors. This is possible only through excellence in execution.

- Buying below median valuations tilts the odds in favour of investors

- The key words are “tilts the odds”. In investing, no methodology can assure a 100% guarantee of success.

QGLP CONNECT

- Consistency is all about Quality of Business (Q) over the long term (L).