Characteristics of Multi-Baggers

A high-growth business, run by an outstanding management, and purchased with a five-year payback outlook of <1, has a good chance of being a big winner.

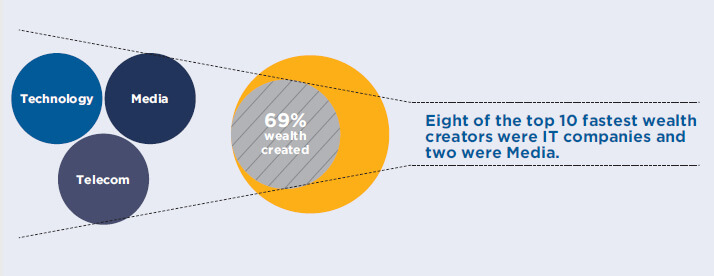

- The study was dominated by the New Age businesses popular as the acronyms TMT (Technology, Media and Telecom) or ICE (IT, Communication, Entertainment)

- The three sectors together accounted for 69% of wealth created during the five-year period of 1995-2000. Eight of the top 10 fastest wealth creators were IT companies and two were Media.

- Most interestingly, all the 10 fastest wealth creators clocked five-year price CAGR of 100%+.

- This set the backdrop for discussing the key characteristics of multi-baggers:

- Growth story where the business has a tailwind

- Huge opportunity size

- Global market orientation

- Great business economics, i.e. favourable competitive landscape leading to high RoE

- Outstanding management (Management should have a long-range profit outlook. It has to have unquestionable integrity.)

- Significant re-rating potential

- Low Payback Ratio, ideally less than 1 (Payback ratio or “purchase price recovery in 5 years” is calculated by dividing Market Cap with expected total profit in next 5 years.)

Bharti Airtel

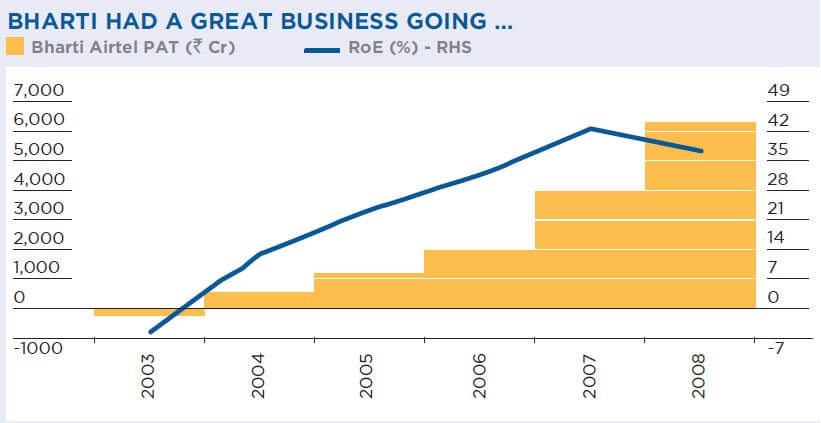

- Bharti Airtel presents a unique case of how a multi-bagger idea can go right … and also, how it can later go wrong! In 2002-03, it had most characteristics of multibaggers discussed in this study – growth story, huge business opportunity, great business economics, and so on.

- For FY03, Bharti’s sales doubled y-o-y to Rs. 3,000 crores and EBITDA went up almost 3 times to Rs. 617 crores. But due to high depreciation and interest, net loss was Rs. 200 crores, and the company was available for Rs. 5,200 crores.

- Bharti turned around in FY04 and went on to earn total profit of over Rs. 14,000 crores in the next five years, i.e. FY03 payback ratio was less than 0.4x (5,200/14,000).

- As predicted by the study, Bharti turned out to be a multibagger – the stock price went up over 40 times in the next five years (from Rs. 14 to a high of Rs. 574, a return CAGR of 110%.

- Of course, later, some key multi-bagger characteristics turned adverse – new licenses led to higher competition affecting business economics, and the management did a mega acquisition of Zain in Africa. As a result, over the next five years, stock price almost halved.

As a multi-bagger, Bharti’s stock price grew 40x over 2004-09 with a return CAGR of 110%. Post-2009, as key multibagger characteristics turned adverse, the stock price almost halved.

Amplifying Quality, Quantifying Price

- Looking back, the 5th Study amplified

the 3rd Study, which essentially

claimed, “Success at investment in

equities calls for:

- Identifying the right business

- Which is run by a competent management, and

- Is acquired at a price which is at a huge discount to its underlying value.”

- This study amplified “right business” as one which has key characteristics like huge size of opportunity, great business economics, and so on.

- Further, the payback ratio suitably quantified the price aspect of a multibagger. Thus, ideally, investors should pay only so much for a business, which can be fully recovered from the profits earned in the first five years after investment.

- Of course, finding a high quality business with a payback ratio under 1 is rare. But even one such idea in a whole year can multiply an investor’s wealth for several years to come!