Commodity Cycles

Commodity prices, profits and stocks rise sharply in the ‘squeeze’ phase of the cycle. But no squeeze is permanent, and prices plummet when it ends. Therefore, the way to make money in commodities and commodity stocks is to ‘sell too soon’.

- 60% of the wealth created during 1999-2004 was by commodity companies.

- A commodity cycle typically goes through five phases:

- Gloom: low capacity utilisation, low prices and low profits (even losses).

- Recovery: moderate capacity utilisation, gradual price escalation, steadily rising profits.

- Squeeze: near-100% utilisation, supply squeeze, sharp price hikes, exponential profits.

- Euphoria: fresh capacity surge in excess of incremental demand, prices dropping off.

- Glut: Excess supply, plunge in product prices, profits disappear.

- Given the above, if one correctly foresees the onset of squeeze, investing in commodity stocks will lead to handsome gains.

- According to John Burr Williams (author of Theory of Investment Value), the market price of a stock is only an expression of opinion, not a statement of fact. He says, “Today’s opinion will make today’s price, tomorrow’s opinion tomorrow’s price.”

- Therefore, when opinions on the ‘squeeze’ phase changes, market prices change instantaneously. Therefore, perhaps the only way to make money in commodities and commodity stocks is to ‘sell too soon’.

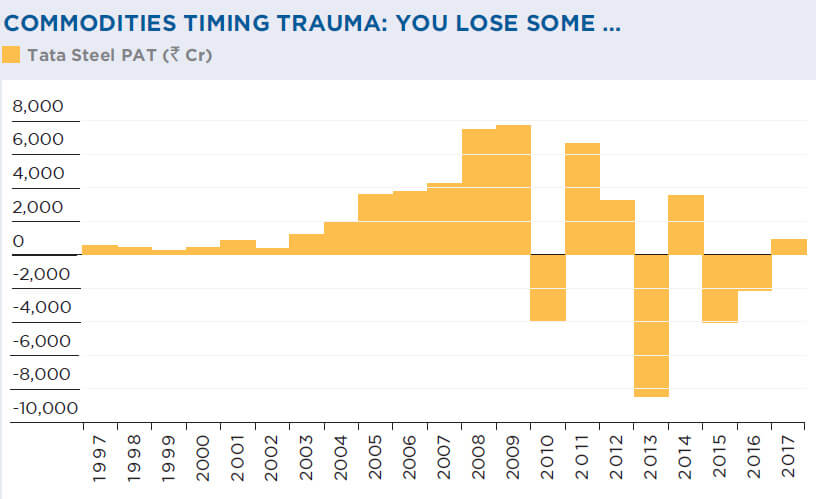

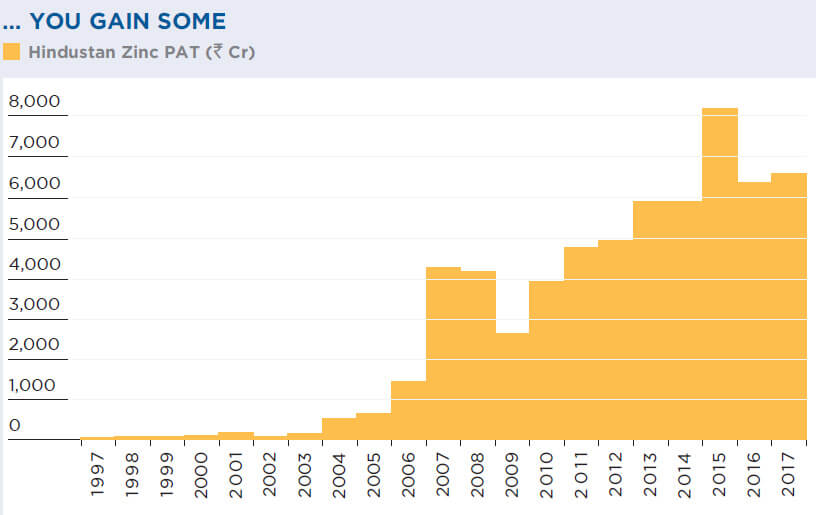

Tata Steel (pre-Corus) and Hindustan Zinc (postgovernment divestment)

- Tata Steel India is one of the world’s most integrated, lowest cost steel producer. Hence, even in the worst of times, it remains highly profitable. However, the acquisition of Corus had a sharply adverse impact on consolidated profitability, which is now almost fully dependent on a favourable commodity cycle.

- Likewise, Hindustan Zinc too is one of the world’s lowest cost zinc producers. However, when it was a government company, its performance was mediocre at best. Its divestment to the Vedanta Group, coinciding with the global commodity boom, had a sharply favourable impact on profitability and stock performance.

Tata Steel’s acquisition of Corus had an adverse impact on consolidated profitability. Hindustan Zinc’s divestment to Vedanta positively impacted profitability and stock performance.

QGLP disconnect: Timing trauma

- Taken independently, each of the QGLP elements – Quality, Growth, Longevity and Price – apply to commodity stocks as well.

- However, an implicit feature of most QGLP stocks is this: the non-imperative to sell. (“The best time to sell is almost never.” – Phil Fisher in Common Stocks, Uncommon Profits)

- But given their cyclical nature, for commodity stocks – no matter how great in quality – this non-imperative to sell does not apply. If investors miss selling before the ‘squeeze’ phase ends, prices will most likely end up at the purchase level, if not lower.

- This trauma of timing both for the purchase and sell is the chief disconnect between commodity stocks and the QGLP philosophy.