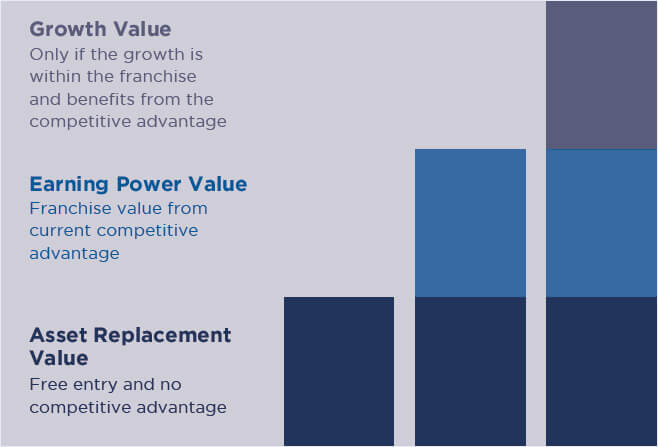

Components of Value

There are five Forces of Wealth Creation:

- Return on Capital Employed

- Capital Employed

- Growth in Capital Employed

- Cost of Capital and 5. Margin of Safety

- Value investing starts with

having a better understanding

of the intrinsic value of the

company than rest of the

market. A company’s intrinsic

value can be divided into

three parts:

- Asset Replacement Value,

- Earning Power Value, and

- Growth Value.

- The only ‘valuable growth’ is the growth in businesses where the firm enjoys a competitive advantage.

- Value of a share is the present value of future free cash flows, and is given by the formula: C x (RoC – G)/(R – G) where C: Capital Employed; RoC: Return on Capital; G: Growth in Capital Employed; R: Cost of Capital.

- The above four factors combined with Margin of Safety, together make up what we call the Five Forces of Wealth Creation.

Source: Value Investing: From Graham to Buffett and Beyond, by Bruce Greenwald, Judd Kahn & others

The Indian Multinational Mania

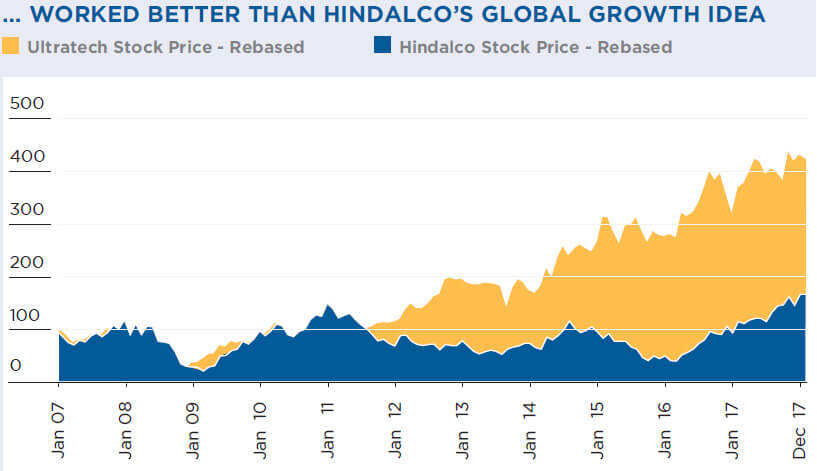

- The noughties (i.e. 2000-10) was marked by the Indian Multinational Mania, i.e. Indian companies making mega acquisitions overseas as part of their quest to become global – Tata Steel-Corus, HindalcoNovelis, Bharti-Zain, Indian Hotels buying Ritz-Carlton (Boston) and Orient Express (New York), and so on.

- These acquisitions had one common feature – they were attempts to grow a different franchise, where the acquirers had no competitive advantage. Most such acquisitions have ended up destroying value for the acquirers and wealth for the investors.

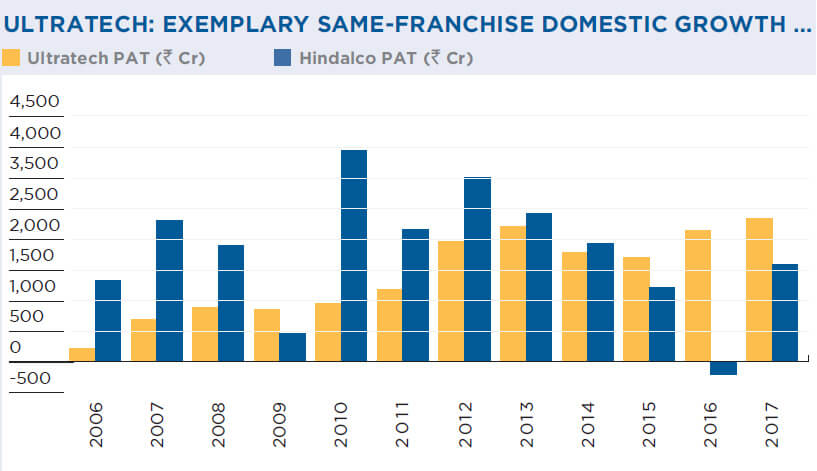

- In contrast, UltraTech has grown by expanding and consolidating its cement franchise in the domestic market. It has performed handsomely, both in terms of profits and stock returns.

UltraTech consolidated its position in the domestic market, resulting in higher profitability and wealth creation. In contrast, Hindalco’s fundamentals (after the Novelis acquisition) did not fare as well.

Quality & Pricing of Growth

- A consistent finding of the Wealth Creation Studies is that most of the wealth has been created by companies with earnings CAGR of 25% or higher.

- Therefore, assessing and valuing growth are critical elements of wealth creation.

- The study emphasises that “all growth is not rewarding; growth has to be in the same franchise of business, where the company has established competitive advantage”.

- Growth is both uncertain and risky, and hence, investors should not overpay for the same, i.e. build in sufficient Margin of Safety in the purchase price.

- The concept of payback ratio (introduced in Study 5) is a useful quantitative tool to assess Margin of Safety.