Transitory vs Enduring Wealth Creators

Multi-baggers could be of two types: transitory and enduring. Transitory multi-baggers are typically created by the combination of cyclical business and questionable quality of management. Only good quality managements running a good business can deliver enduring multi-baggers.

- Multi-baggers are super stocks that multiply in value over a period of time. Investment in such companies can change the overall performance of the portfolio, which can, thus, generate superior returns compared to the average returns from the market.

- Enduring multi-baggers are those companies, whose wealth creation is long lasting. In such stocks, the correction from the peak valuation is limited. They appear to be expensive at the time of buying, because of the lack of faith in the longevity and magnitude of growth. Enduring multi-baggers are few and difficult to spot.

- Transitory multi-baggers are typically cyclicals and fad companies with questionable quality of management.

- The key factors behind

creation of multi-baggers are:

- Quality of business,

- Quality of management, and

- Huge margin of safety in the purchase price.

To achieve satisfactory investment results is easier than most people realise; to achieve superior results is harder than it looks.

- Benjamin Graham

GRUH Finance

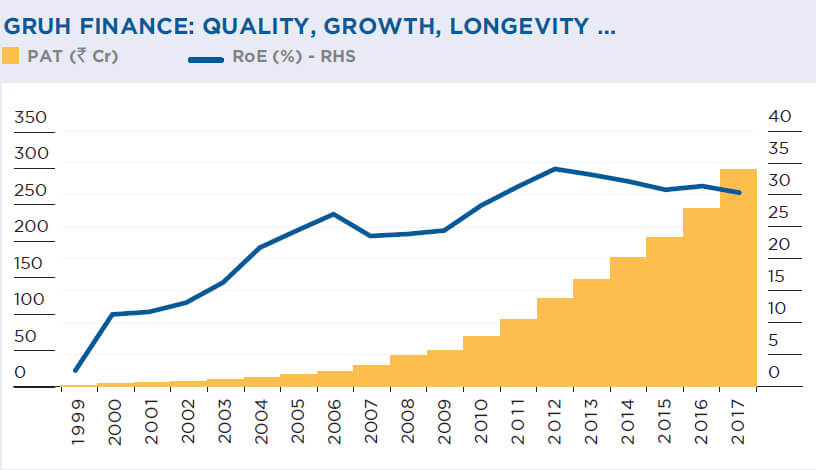

- GRUH Finance is a classic case of an enduring multi-bagger.

- Quality of business: Housing finance in smaller cities and towns is a huge business opportunity for a very long period of time.

- Quality of management: GRUH’s turnaround in fortunes started in Jun-00, when it became a subsidiary of HDFC Group (acquired 26% stake held by Gujarat Ambuja Cements to increase its total stake to 54%).

- Huge margin of safety: Even a good two years after the HDFC group takeover, GRUH was available for a market cap of Rs. 46 crores, less than 0.7x Price/Book.

- 322-bagger in 15 years: GRUH Finance stock price is up 322x in the last 15 years, i.e. return CAGR of 47%+ … and the story still seems enduring!

Gruh Finance is an enduring multi-bagger, with its stock price up 322x in the last 15 years, translating to a CAGR of 47%+.

QGLP – Great natural formula for multi-baggers

- QGLP captures all the factors essential

for the creation of multi-baggers:

Q:

Covers both quality of business and quality of management;

G:

Covers growth in earnings;

L:

Without longevity, there will at best be transitory multi-baggers not enduring ones;

P:

Price of purchase is a key driver of multi-baggers.

- Disciplined application of QGLP is a great natural formula to end up owning quite a few rare enduring multibaggers, which are otherwise difficult to spot.