Role of Interest Rates

At all times, in all markets in all parts of the world, the tiniest change in interest rates changes the value of every financial asset.

- Warren Buffett

- Investing means laying out money today to receive more money in real terms tomorrow, i.e. after taking inflation into account.

- No value, whether of bonds or equities, is absolute. It is always related to the riskfree rate that government securities offer. Therefore, if the interest rate on government securities rises, the prices of all other securities must adjust downward to a level that brings the risk-adjusted rate of return to parity and vice versa.

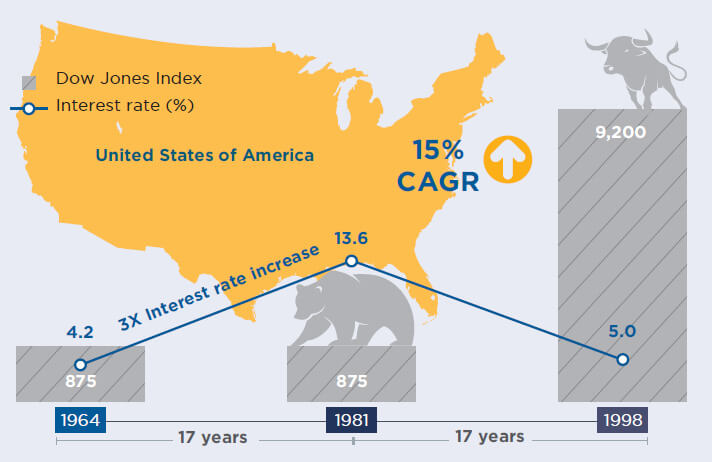

- The tripling of interest rate in the US between 1964 and 1981 (from 4.2% to 13.6%) ensured that the Dow Jones Index was at 875 levels even after 17 years.

- The trend reversed when interest rates fell from 13.6% in 1981 to 5% in 1998, pushing up the Dow to 9,200 levels (17-year CAGR of 15%).

- Indian conditions in 2002 seemed similar to that of the US in 1981, with G-Sec rates correcting from 14% in 1996- 97 (regulated) to a nearderegulated 6% in 2003.

- Sensex earnings yield was at 9%, making equities significantly attractive vis-à-vis debt. Thus, significant market upswing was a certainty, and only a matter of time.

Likely easing of interest rates to boost Indian markets

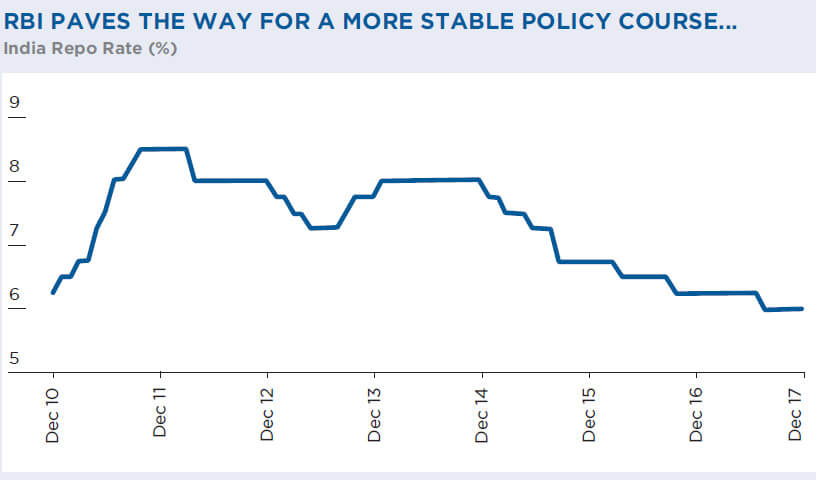

- The RBI has cut rates by 200bp over December 2014 to December 2017. As a result, G-Sec yields too softened from their high levels of 8.5% to 9%.

- Sharply lower inflation and better fiscal situation create an enabling environment for RBI to ease rates further, which is favourable for valuation multiples.

- In parallel, economic recovery should drive up corporate profits.

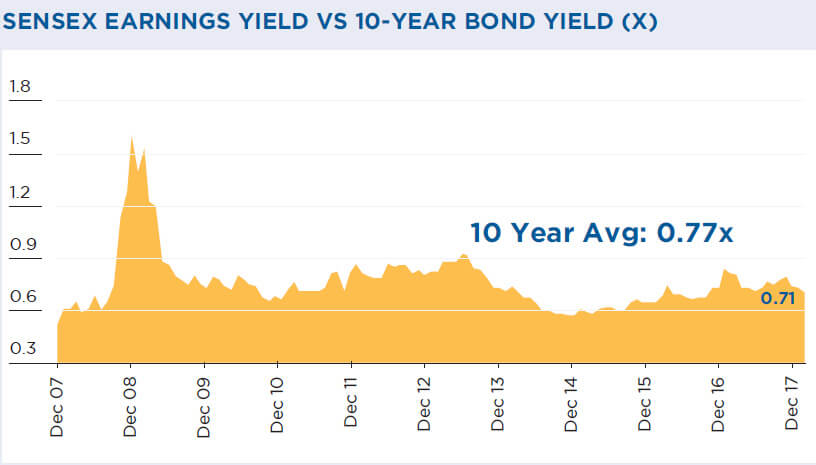

- Sensex Earnings Yield to Bond Yield is only marginally lower than its long-period average.

All these factors will likely keep Indian markets buoyant.

Softening inflation and an improving fiscal situation create an enabling environment for the RBI to ease interest rates further, which in turn should keep Indian markets buoyant.

Interest rates & stock prices

- The study was more macro, and does not have a strong connect with QGLP.

- Still, it established the fact that lower

(or higher) interest rates affect stock

prices in two ways:

- In the short-term, by raising (or lowering) valuation multiples (to bring earnings yield on par with risk-free bond yield); and

- In the medium and long term, by lowering (or raising) interest cost, in turn, raising (or lowering) earnings itself.

- Hence, all other things remaining constant, investors should always keep a watchful eye on interest rate movements.