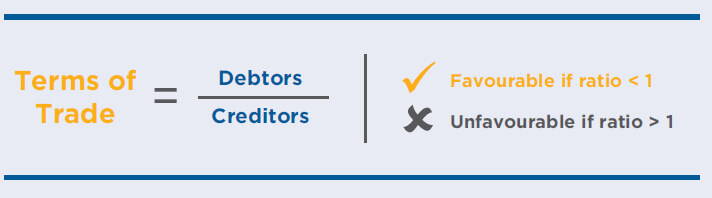

Terms of Trade

Favourable terms of trade are an important characteristic of a wealth creating company. Terms of trade are broadly stable; but when they change from adverse to favourable, the impact on the speed of wealth creation can be significant.

- The study proved that Indian entrepreneurship has come of age. Firstly, domestic companies accounted for over 90% of the wealth created for the fourth consecutive year. Further, within domestic companies, the share of state-owned companies declined to 36% from 48-50% in the previous two studies, i.e. share of Indian entrepreneurship was rising.

- Terms of trade may be defined as ‘the relationship between debtors and creditors’, and measured as the ratio of debtors to creditors (in percentage terms).

- Terms of trade determine working capital requirements. A company enjoys favourable terms of trade if its debtors are lower than its creditors and vice versa.

- Whether a company enjoys favourable or unfavourable terms of trade depends on its bargaining power vis-à-vis its suppliers and customers. Typically, companies with a strong brand equity and/ or dominant market position enjoy high bargaining power

- Almost 80% of wealth creators (excluding banking) had favourable terms of trade, and over 70% of wealth destroyers had adverse terms of trade.

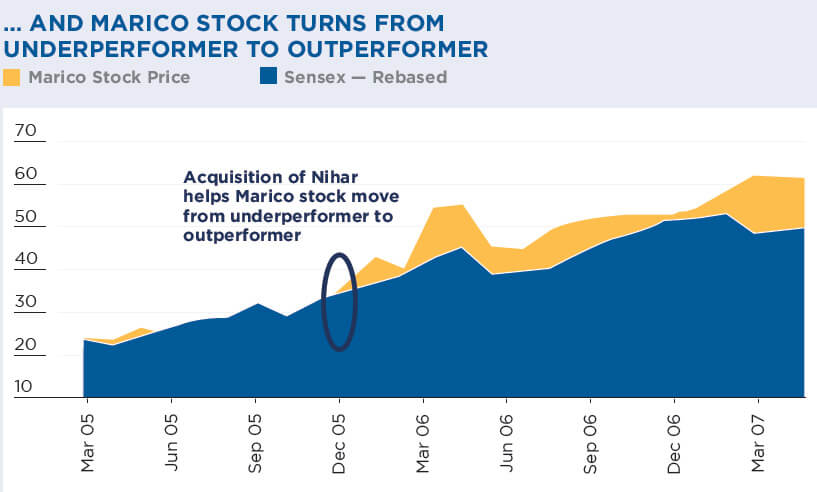

- When terms of trade turn from adverse to favourable, RoCE improves meaningfully, in turn enabling significant wealth creation.

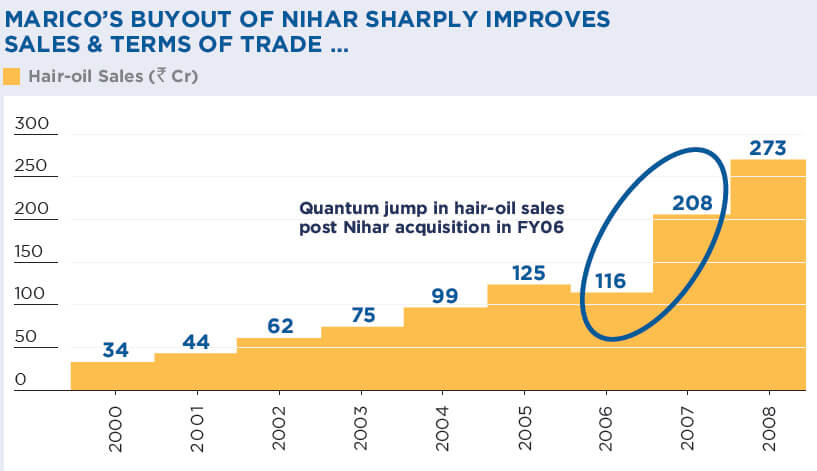

Marico

- Marico was always a dominant player in the branded coconut hair-oil segment given its popular brand “Parachute”.

- And yet, its terms of trade, both with distributors and end-customers, was not that strong given competition from (1) large unorganised sector; and (2) a distant second brand, Nihar of Hindustan Unilever.

- Nihar came to the HUL fold in 1993, when it acquired Tata Oil Mills (TOMCO). It was earlier popular as Tata Nihar.

- Nihar had a 9% market share, but HUL did not consider it among its power brands.

- In early 2006, Marico acquired Nihar from HUL. With this, it significantly consolidated its position in the branded coconut hair-oil market, improving its terms of trade with distributors and endcustomers.

Since acquiring Nihar from HUL in 2006, Marico consolidated its position in the branded coconut hair-oil market, significantly improving its terms of trade with distributors and customers.

Terms of Trade — A Proxy for Quality

- Companies with favourable terms of trade typically enjoy high margins, low capital intensity (i.e. high RoCE/RoE) and strong free cash flows.

- This is because, “such companies are typically stronger, with better brand equity, better sales organisation and greater financial muscle than their peers.”

- Companies with adverse terms of trade often lose control over their destiny. Their high need for external funds makes them dependent on banks and other short-term lenders.

- Thus, one way to look at it is that highquality companies enjoy favourable terms of trade. The converse also mostly holds true, i.e. “Favourable terms of trade imply a high-quality company.”