Next Trillion Dollar Opportunity

India’s NTD (Next Trillion Dollar) of GDP journey will see distinctly buoyant corporate profits and significant boom in savings and investment.

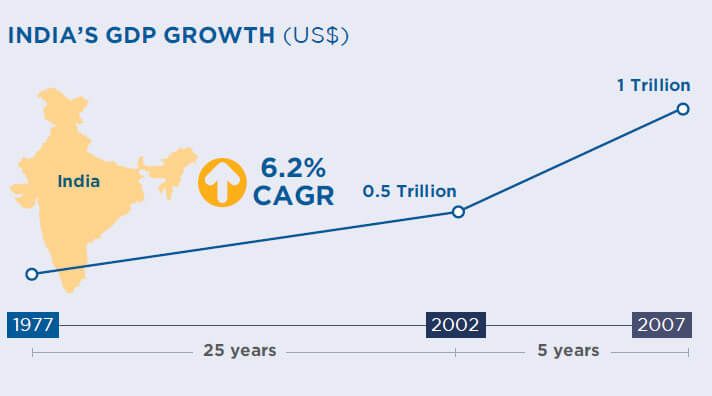

- For 25 years from 1977, India’s nominal GDP (US$ terms) grew at 6.2% CAGR to US$ 0.5 trillion in 2002. However, in the next five years alone, India’s GDP doubled to US$ 1 trillion by 2007.

- Going forward, in every five to seven years, India will add its Next Trillion Dollar (NTD) of GDP. This linear GDP growth will translate into exponential opportunity for several businesses, especially those where the demand/spending is discretionary – beverages, cars, telecom, education, recreation, and so on.

- Boom in savings and investment on the back of rising GDP and per capita GDP spells excellent growth for sectors like financial services, capital goods, cement and steel.

- Rising private sector participation in the Indian economy and easy access to capital (both domestic and foreign) are the two key drivers of exponentiality in India Inc sales and profits.

Page Industries

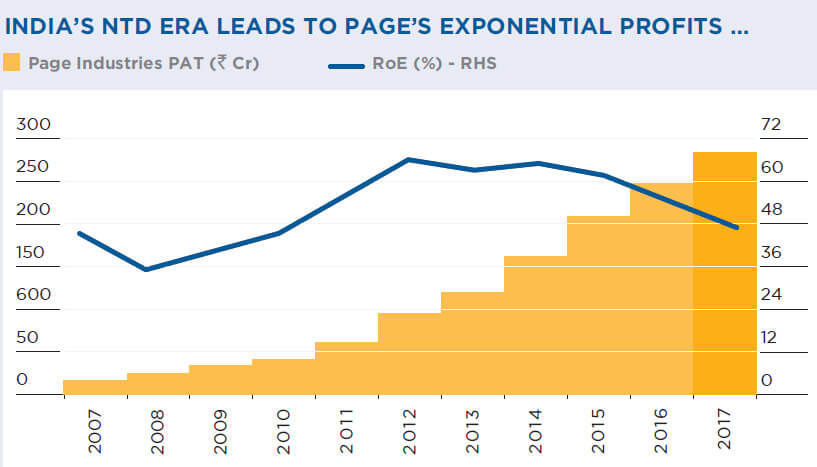

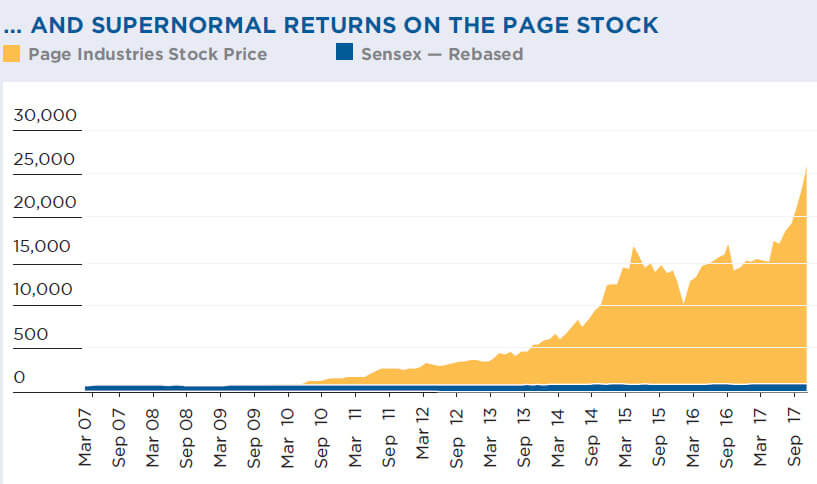

- Page Industries, which makes and sells the ‘Jockey’ brand of innerwear, is a classic case of how India’s NTD era brings exponential growth for many businesses based on discretionary consumer spend.

- The innerwear market is growing linearly. But rising prosperity is leading to both ‘premiumisation’ and globalisation. Thus, the affluent class increasingly prefers a global brand even for innerwear. Page Industries fits the bill perfectly.

Page Industries represents how India’s Next Trillon Dollar era, driven by rising prosperity is leading to both ‘premiumisation’ and globalisation, implying exponential growth for many businesses.

India’s NTD journey - the underpinning for long-term growth

- The concept of NTD (Next Trillion Dollar of GDP) is proprietary to Motilal Oswal, and forms the underpinning for long-term growth investing in India.

- GDP growth is linear; but on a high base, even linear GDP growth keeps enlarging the absolute GDP pie. Thus, on a GDP base of US$ 0.5 trillion, when GDP doubles over time, it translates to an additional US$ 0.5 trillion. But on a GDP base of US$ 2 trillion, doubling of GDP implies additional US$ 2 trillion, which is 4x that of US$ 0.5 trillion.

- Additionally, India’s GDP stands at US$ 1.8 trillion, less than 2.5% of world’s GDP of US$ 75 trillion. Thus, there is a long way to go for India to increase its world GDP share.

- Moreover, some businesses like IT and pharma even enjoy globally competitive advantage.

- Thus, India is one of the best markets to practise long-term growth investing.