Great, Good and Gruesome

A proper insight into Great, Good and Gruesome companies is critical for long-term investment success. Gruesome companies are best avoided.

- In his 2007 Annual Letter to Berkshire Hathaway shareholders,

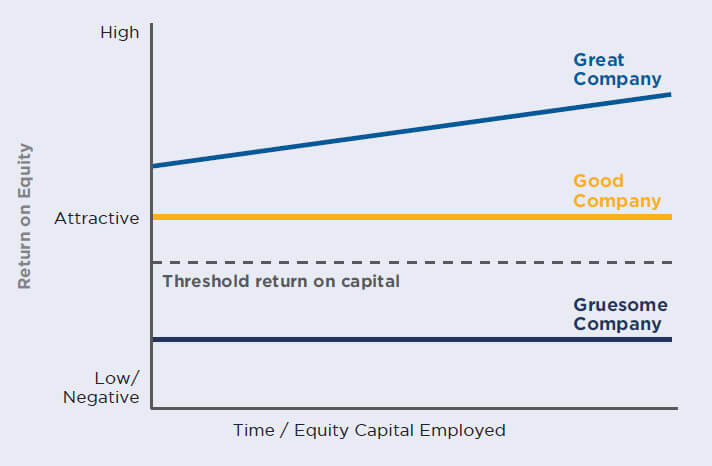

Warren Buffett says, “Think of three types of savings accounts:

- The Great one pays an extraordinarily high interest rate that will rise as the years pass.

- The Good one pays an attractive rate of interest that will be earned also on deposits that are added.

- Finally, the Gruesome account both pays an inadequate interest rate and requires you to keep adding money at those disappointing returns.”

- A Great company has an enduring moat (i.e. long-term competitive advantage) that protects excellent returns on capital. This is possible only if:

- It possesses powerful brand(s) or

- It is a low-cost producer.

- Great companies are fountains of dividend.

- Good companies are fountains of earnings. They grow at healthy rates, but need significant capital infusion from time to time to sustain growth.

- Paradoxically, Gruesome companies tend to enjoy very high growth rate, which turns out to be a trap. They effectively are ‘bottomless pits of capital consumption.’

- Best investment strategy: Buy ‘Good’ companies at great (bargain) price or buy ‘Great’ companies at good (reasonable) price.

HUL, Sun Pharma, Tata Teleservices

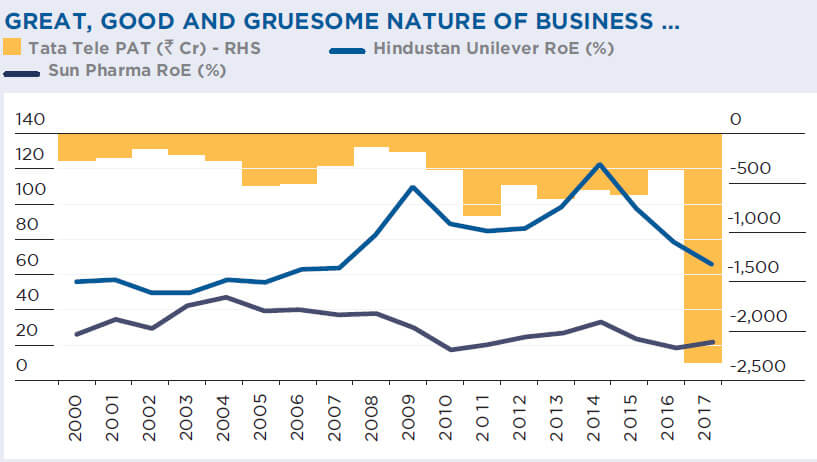

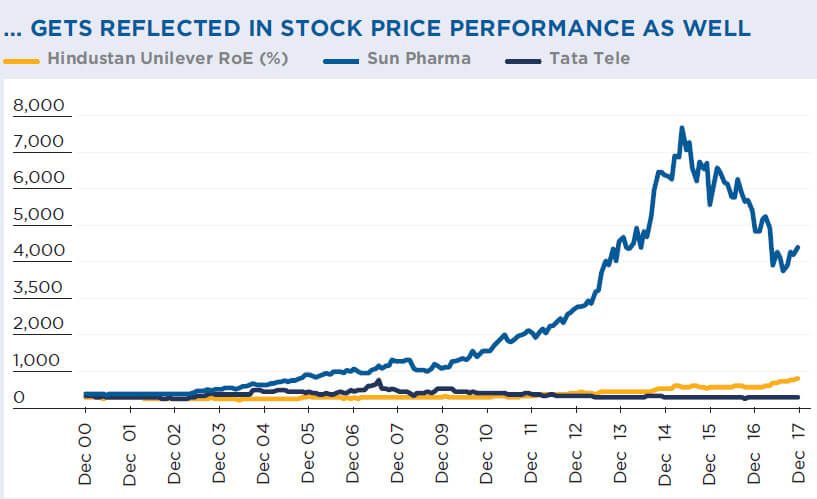

- These three companies are textbook examples of Great, Good and Gruesome businesses.

- Hindustan Unilever: The company has a wide range of well-established products (soaps & detergents, cosmetics, tea, ice-creams, etc) with a strong distribution network i.e. an enduring moat. Growth rate is not very high, but requires virtually no incremental capital (RoE levels well over 50%).

- Sun Pharma: It has solid competitive advantage in generic exports. Growth rate is very healthy and RoE is over 30%, but this requires regular doses of capital investment.

- Tata Teleservices: Tata Teleservices has not reported a profit in any single year for the last 15 years. And yet, Capital Employed has gone up seven fold over this period.

Hindustan Unilever (a Great business) requires no incremental capital; Sun Pharma (Good) requires regular capital investment; Tata Teleservices (Gruesome), unprofitable for the last 15 years, has had 7x Capital Employed growth.

Quality and Growth, but at a Price

- It may well be said that the ‘Q’ of our QGLP investment philosophy got entrenched with this study.

- The Quality-Growth trade-off also is clear – “Great companies tend to grow slower than their ‘Good’ and ‘Gruesome’ counterparts. But the key aspect of this growth is that it is achieved by consuming very little additional capital. Over time, given the power of compounding, ‘Great’ companies become significant cash machines with high and steadily rising RoE, and high dividend payouts.”

- But Quality should not blind investors to purchase Price because even “Great companies need not be great investments. Great investments are the result of huge margin of safety at the time of purchase.”

- And finally, the most important takeaway of this study: “Gruesome companies are best avoided, whatever the price!”