Winner Categories & Category Winners

1. |

Winner Categories |

= |

India’s NTD opportunity + Scalability |

2. |

Category Winners |

= |

Winner Categories + Entry Barriers + Great Management |

3. |

Winning Investments |

= |

Category Winners + Reasonable Valuation |

- The 2009 Study revisited India’s NTD journey (2007 Study) and juxtaposed it with McKinsey Global Institute’s report ‘The Bird of Gold: The Rise of India’s Consumer Market’.

- Winner Categories are sectors, which are expected to grow at least 1.5 times the nominal rate of GDP growth. Linear doubling of India’s GDP from US$ 1 trillion to US$ 2 trillion in 5-7 years would mean exponential opportunity for sectors like processed food, alcoholic beverages, autos, banking and finance, entertainment, telecom, healthcare, capital goods, housing, among many others.

- Category Winners are companies within these Winner Categories, which enjoy:

- Entry barriers (i.e. long-term competitive advantage) and

- Great management.

- Winning Investments are made when Category Winner stocks are bought at reasonable (but not necessarily cheap) valuations.

HDFC Bank

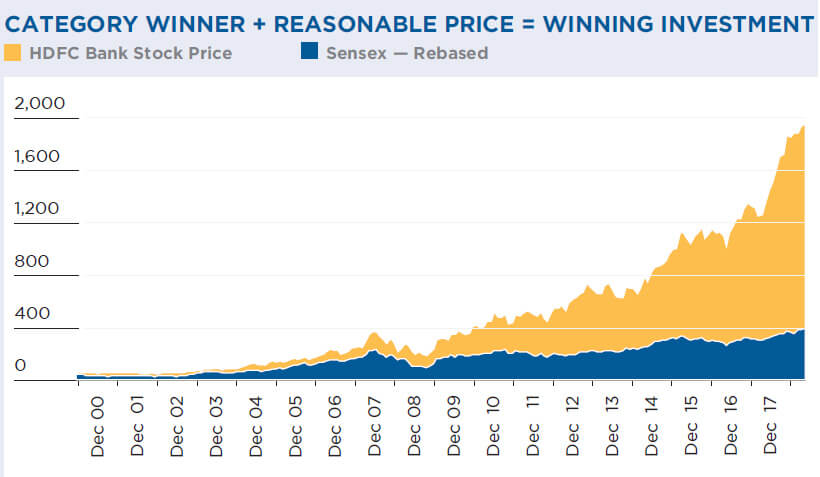

- HDFC Bank is a perfect example of how Winner Categories and Category Winners combine to deliver Winning Investments.

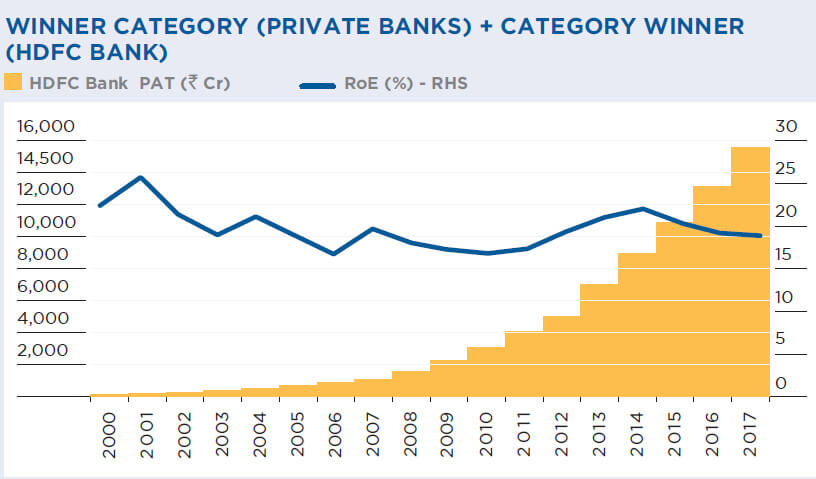

- Over the last two decades, private banks in India have emerged as a major Winner Category, with strong growth driven by consistent innovation and technology adoption. The picture is not so encouraging when we look at public sector banks.

- Within the Winner Category of private banks, HDFC Bank has high entry barriers (brand, visibility) and great management (HDFC as promoter group).

- Although HDFC Bank has never been really cheap in terms of valuation, it has proved to be a long-term Winning Investment.

Private banking is a Winner Category with growth led by innovation and technology. HDFC Bank is a Category Winner with a strong brand and great management. If bought at reasonable price, it will be a Winning Investment.

QGLP applied top-down

- The ‘Winner Categories, Category Winners’ study shows how QGLP is applied top down.

- G(rowth) and L(ongevity) are captured at the sector level in Winner Categories, i.e. those which grow by at least 1.5 times of GDP growth rate for quite some time to come.

- Having identified G and L, the Q(uality) comes at the company level in the form of Category Winners, i.e. those armed with entry barriers and high-quality management.

- Finally, the P(rice) is considered at the stock level in the form of Winning Investments, i.e. Category Winners bought at reasonable (but not necessarily throwaway) valuation.