UU Investing:

Wealth Creation from the Unknown & Unknowable

A stock’s journey from UU (Unknown & Unknowable) to KK (Known & Knowable) is marked by high earnings growth, coupled with sharp valuation re-rating, leading to rapid wealth creation.

- In many cases, the stock market presents investors with a different dimension of uncertainty, bordering on the world of ignorance or the Unknown and Unknowable (UU).

- Classical examples:

- A new company in a new business (e.g. casino company in India), or

- A company prospecting for precious metals such as gold.

- Infosys’ IPO in 1994 was also a textbook UU situation.

- Since UU is a situation where future states of the world are unknown, UU investing is the art of ‘selecting assets that will fare well when future states of the world become known.’

- The three major steps for the first-time UU practitioner are:

- Knowing the success principles of UU investing,

- Looking out for UU situations,

- Being aware of pitfalls.

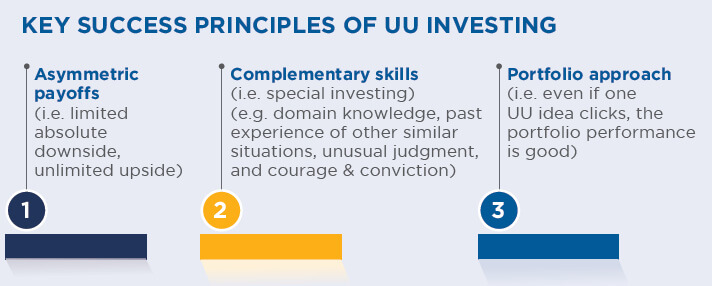

- The key success principles are:

- Asymmetric payoffs (i.e. limited absolute downside, unlimited upside)

- Complementary (i.e. special investing) skills (e.g. domain knowledge, past experience of other similar situations, unusual judgment, and courage and conviction), and

- Portfolio approach (even if one UU idea clicks, the portfolio performance is good).

- UU situations include short history of the industry/ company, change in regulation, value migration (e.g. wired to wireless phones), profit turnaround, management change, and so on.

- Two major pitfalls of UU investing are:

- Overconfidence and

- Hindsight criticism.

Deccan Gold Mines

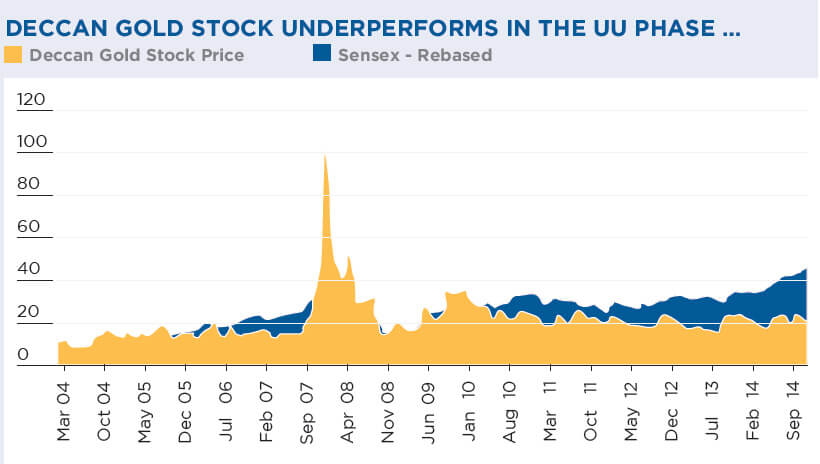

- Deccan Gold Mines is the first listed company engaged in gold exploration, which by its very nature is UU. Further, the company had applied mining proposals to the government, which were at various stages pending approval.

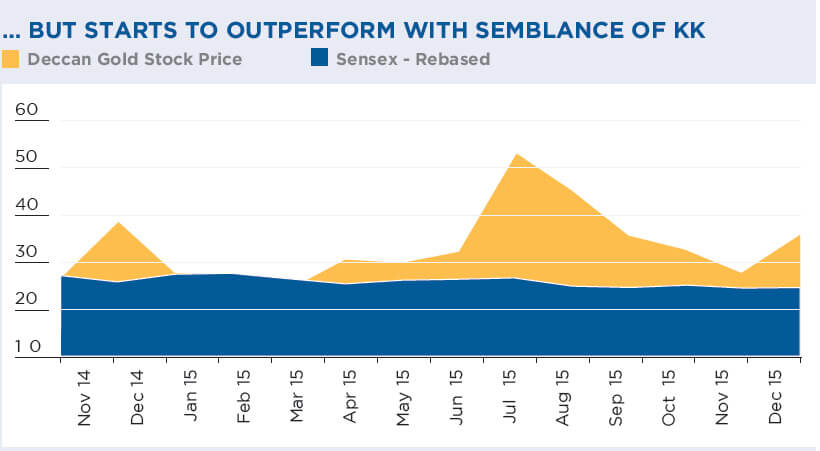

- For quite asome time, the stock was underperforming in the markets. In early Nov-14, there were reports of the company’s mining proposals likely to be considered favourably by the government.

- The stock has since shot up significantly, and Deccan Gold investors finally hit gold!

Deccan Gold Mines underperformed in the UU phase during Jan-10 to Sep-14. However, post that, the stock price has improved significantly.

QGLP and UU –

Two distinctly different frameworks

- The contrast between QGLP and UU investing frameworks is interesting.

- The very first QGLP principle is to understand the quality of business and management. However, UU by its very deinition is ‘Unknown & Unknowable’; hence, the question of clear understanding does not arise.

- Likewise, Growth and Longevity in UU situations are also extremely uncertain.

- One remotely common element between the two is Price. Whereas in QGLP a reasonable price is good enough, under UU, paying a very low price is non-negotiable in order to improve the probability of asymmetric payoff.

- The other common element, of course, is the quality of analysis and judgment, which leads to courage and conviction of the investment decision.