Blue Chip Investing: Wealth Creation through Dividends

Blue Chips are fountains of dividend and offer as much, if not more, investment growth potential than companies with far less brand recall, but with far less risk as well.

- ‘Blue Chip’ is a common term used for highly priced stocks, which typically tend to enjoy premium valuations due to their high quality. They are also sometimes referred to as bellwether stocks.

- Two key steps of Blue Chip Investing are:

- Understanding quality, and

- Recognising value.

- Six criteria help shortlist high-quality Blue Chips:

- 20 years of uninterrupted dividends;

- Dividends raised in at least 5 of last 12 years;

- Earnings growth in at least 7 of last 12 years;

- Average RoE of at least 15% for the last 12 years;

- At least 5 million shares, and

- Owned by at least 80 institutional investors.

- Blue Chips almost invariably enjoy premium valuations. This is because, mathematically, P/E = Payout/Dividend Yield. Since payout in Blue Chips tends to be high, so does their P/E.

- The two signals to consider buying into Blue Chips are:

- Dividend yield higher than 10-year median and PE lower than 10-year median,

or - Dividend yield greater than 3%.

- Dividend yield higher than 10-year median and PE lower than 10-year median,

- Blue Chip Investing is primarily a buy-and-hold strategy. And yet, in the rare case of gross over-valuation, even Blue Chips should be sold, and repurchased when prices correct to below median valuations.

Asian Paints

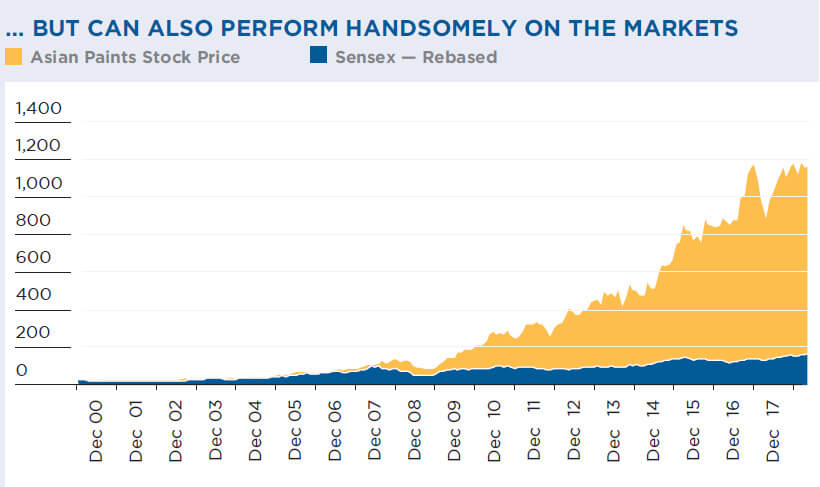

- Asian Paints is a typical example of the elusive Blue Chip; one which most portfolio managers would love to own ‘only if it got a little cheaper!’ It never has, and seems unlikely it ever will be.

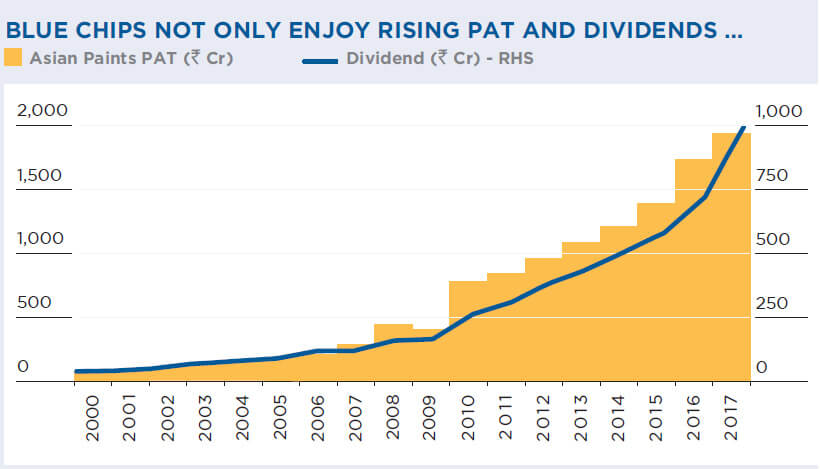

- And all this while, the company has steadily grown profits, dividends and needless to add, handsomely outperformed the market benchmarks.

Asian Paints represents the elusive Blue Chip. Its valuation always remains rich, and yet the stock outperforms the market given steady growth in profits and dividends.

Decoding the Quality – Price Dilemma

- The contrast between QGLP and UU investing frameworks is interesting.

- The Quality, Growth (modest but steady) and Longevity of Blue Chips are never in doubt, and thus are always worth owning.

- This study has made a significant contribution by resolving the dilemma as to why Blue Chips always seem very expensive given their high P/Es.

- The mathematical connect between dividend payout and P/E makes it clear why Blue Chips like Hindustan Unilever, Nestle, Asian Paints and Colgate are valued at a significant premium in the market, even as their earnings growth rates remain modest.

- The long-term outperformance of Blue Chips further reinforces yet another Motilal Oswal investment credo ‘Buy right. Sit tight!’