Economic Moat: Fountainhead of Wealth Creation

Great companies are like wonderful castles, surrounded by deep, dangerous moats. Roughly translated, we like great companies with dominant positions whose franchise are hard to duplicate and has tremendous staying power or some permanence to it.

- Warren Buffett

- Akin to a traditional moat (i.e. water-filled trench around a castle), an Economic Moat protects a company’s profits from the onslaught of multiple business forces, primarily competition. Terms such as ‘Sustainable Competitive Advantage’ or ‘Entry Barriers’ essentially connote the idea of an Economic Moat.

- In the long run, equity investors can only make as much money and return as the company itself makes. Hence, it pays to invest in companies with formidable Economic Moats, as this is the only way to ensure sustained superior profitability and wealth creation.

- The strength of a company’s Economic Moat is determined by:

- Industry structure, and

- Its own strategy.

- Industry structure may be favourable or unfavourable depending on the bargaining power with customers and suppliers, threat of new entrants and government policy, among others. As industry structure is broadly the same for all incumbents, it is every individual company’s strategy, which finally determines the strength of its moat.

- A company’s Economic Moat needs to ultimately reflect by way of Return on Equity (RoE) superior to peers in a sustained way (i.e. at least 7 of 10 years). Economic Moat Companies tend to significantly outperform the market, and those companies without moats.

Eicher Motors

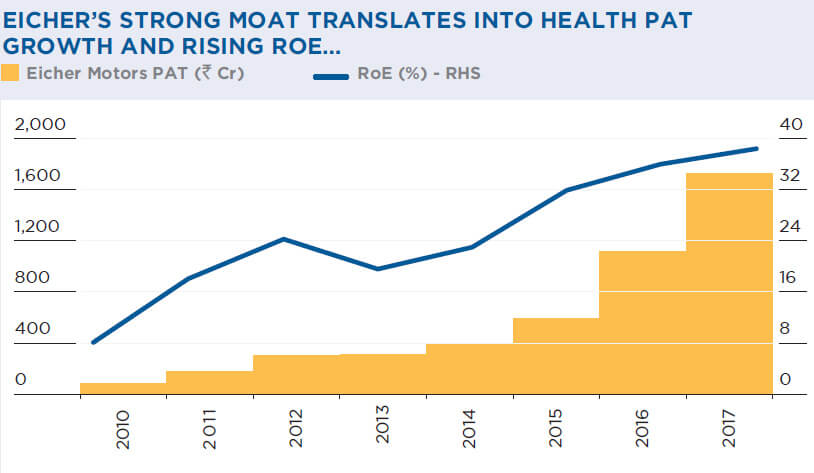

- Eicher Motors is a good example of a company with strong Economic Moat.

- It enjoys 95% share in 250cc+ motorcycles through the Royal Enfield brand. Eicher is the only 2-wheeler company with significant pricing power due to lack of competition in the leisure bikes segment.

- Further, Eicher has 54% stake in its JV with Volvo (Volvo-Eicher Commercial Vehicles Ltd), which is India’s third largest commercial vehicles player.

- The company is asset light and high cash generating with latest RoE of over 35%.

- Eicher is strengthening its moat by launching new variants and also foraying into the export market.

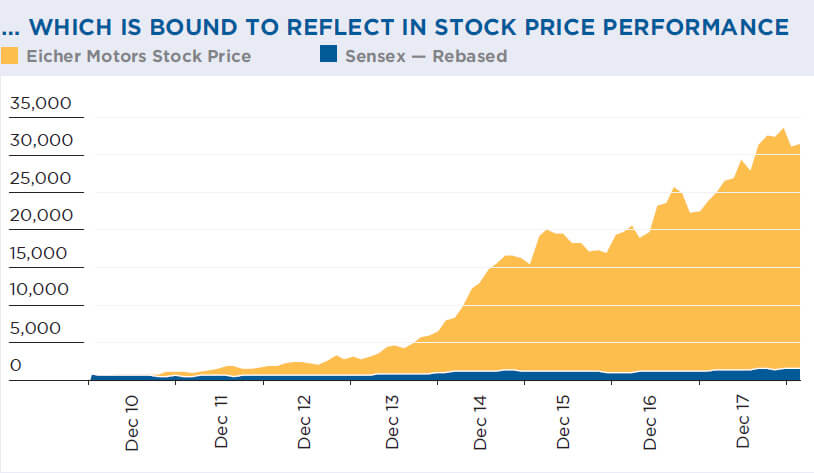

- As a result of all the above, the company has seen rising PAT and RoE, and the stock has handsomely outperformed the market in the last seven years.

Eicher derives its Economic Moat from its 95% market share in leisure bikes and a majority stake in India’s third largest CV player. The company has seen rising PAT and RoE, and the stock has handsomely outperformed the market in the last seven years.

Quality more important than price

- Even as the Blue Chip study decodes the Quality-Price dilemma, the Economic Moat study almost liberates the investor from the valuation enigma.

- Essentially, Economic Moat companies are likely to outperform over the long term, irrespective of sector, earnings growth and valuation.

- The strong competitive advantage of Economic Moat companies ensures that they enjoy a more-than-fair share of the growth inherent in most sectors in India.

- Also, markets seem unable to fairly value high-quality growth sustained over the long term. Hence, stocks of economic moat companies outperform even if they were bought somewhat expensive.