Uncommon Profits: Emergence & Endurance

Uncommon profits in companies (Value Creators) lead to uncommon wealth creation in stock markets. Successful emergence of value creators is very rare; a strong corporate-parent in a non-cyclical business significantly increases the probability.

- In the long run, investors earn only as much money on a stock as the underlying business itself earns. Hence, it pays off well to invest in companies, which generate Uncommon Profit (i.e. return on capital is much higher than cost of capital).

- Uncommon Profitability (% terms) = RoE > Cost of Equity. In the Indian context, cost of equity is 15%, which is the long-term return on the benchmark equity indices.

- Emergence is a company’s first entry into the potential Uncommon Profit zone. Its next challenge is Endurance, i.e. sustaining RoE above 15% for a long period of time.

- Successful emergence is a combination of key factors at the industry level as well as the company level.

- Industry-level factors include

- Competitive landscape;

- Size of profit pool;

- Industry stability; and

- New industry/strategic opportunity.

- Company level factors include

- Quality of corporate parent/management;

- Unique value proposition or strategy;

- Nature of business (e.g. Consumer-facing or Industry-facing), and

- Market leadership.

- Successful emergence is rare. Hence the need to consider investing in Enduring Value Creators, which also outperform markets over the long term.

Jubilant Life Sciences

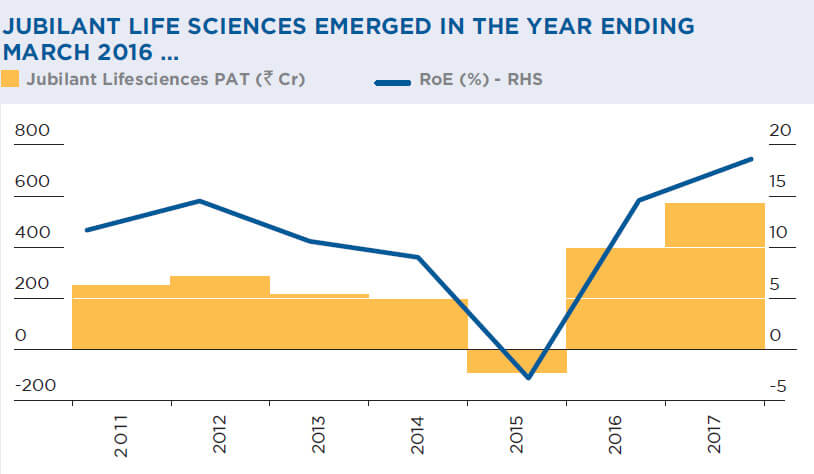

- Jubilant Life Sciences has Emerged in the year ending March 2016 (its RoE exceeded 15% after a long gap).

- It seems to have many of the key success criteria for a successful Emergence:

- Strong corporate parent (Bhartia group which includes Jubilant Foodworks)

- Huge opportunity size (global pharma)

- Unique value proposition (fully integrated player, diversified product profile including specialty products like radio-pharmaceuticals) and

- Consumer-facing business.

Jubilant Life Sciences has Emerged in the year ending March 2016 (i.e. entered the Uncommon Profit zone of RoE >15%). It enjoys many key criteria for a successful Emergence i.e. strong corporate parent, huge opportunity, unique value proposition and consumer-facing business.

Catch ’em early

- Emergence is all about identifying QGL (Quality, Growth and Longevity) early in a company.

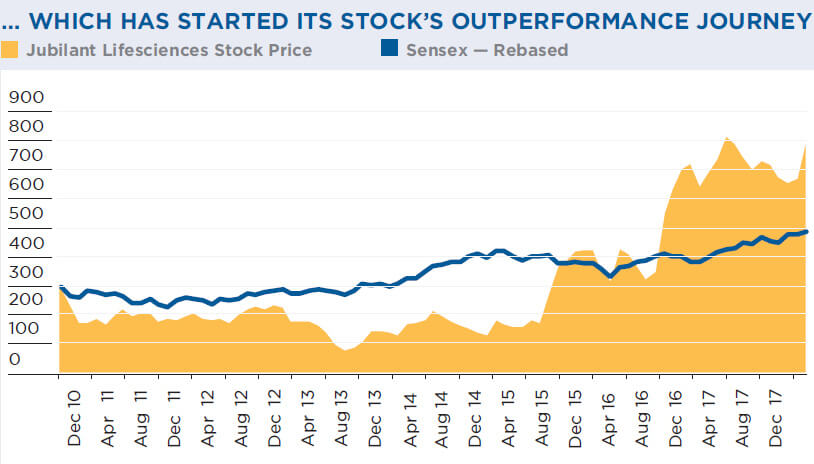

- The key idea here is that at the point of Emergence typically, Quality of a company is not fully discovered by the market. Hence, its stocks can be bought at a reasonable price, and returns can be ‘Uncommon’.

- Notably, mere Emergence into the Uncommon Profit zone is not sufficient. Uncommon Wealth Creation happens only if Uncommon Profits are endured over the long term. Such endurance is purely a function of the quality of business, and quality of management.

- Hence, always Quality first!