100x: The Power of Growth in Wealth Creation

100x stocks are few. Finding them requires "vision to see, courage to buy, and the patience to hold."

- ‘100x’ refers to stock prices rising 100-fold over time, i.e. ‘100-baggers’ in stock market jargon. The precise number of ‘100’ is not as important as the fact that 100x opens the mind to the power of ong-term compounding in equity investing.

- In India, the benchmark indices tend to go 100x in 30 years, i.e. 17% CAGR. Considering the reality, smart investors should target to achieve 100x in less time, say, 20 years (26% CAGR).

- The study identified 47 enduring 100x stocks during 1994-2004, i.e. which rose 100-fold or more during the 20 years, and maintained their 100x status as of March 2014 price levels.

- The essence of 100x stocks lies in the alchemy of five elements forming the acronym SQGLP – Size (small, relatively unknown company), with high Quality (of business and management), Growth (in earnings), Longevity (of quality & growth) and favourable Price.

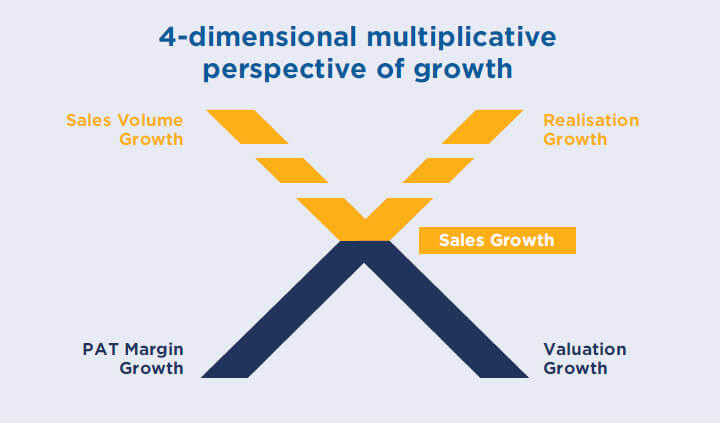

- Mathematically, 100x stock price can happen by way of a three-dimensional multiplicative growth – sales growth, profit margin growth and valuation growth.

- In the final analysis, management with integrity, competence and growth mindset is the 100x alchemist. Phil Fisher, the distinguished guru of growth investing, had once said, “in evaluating a common stock, the management is 90%, industry is 9% and all other factors are 1%.”

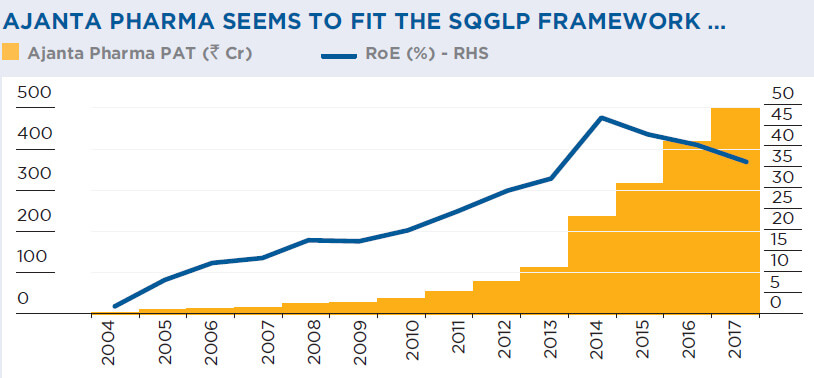

Ajanta Pharma

- S (Size): In FY12, the company’s sales were less than Rs. 700 crores with market cap of Rs. 500+ crores.

- Q (Quality of business & management): Biscuits, bread, cakes and dairy products are consumer-facing, steady state businesses. There is steady value migrating from the unorganized sector to the organized sector. The competitive landscape is fairly favourable with only 3 major players – ritannia, Parle and ITC. There was a change in management with Varun Berry replacing Vinita Bali as the CEO.

- G (Growth in earnings): FY12 PAT at Rs. 77 crores was already 3x the FY09 figure of Rs. 25 crores, i.e. earnings growth momentum was clearly visible.

- L (Longevity): The pharma opportunity lends significant longevity to the company’s growth.

- P (Price): As of Mar-2012, stock P/E was less than 7x.

- S: SQGLP can be effectively applied in private equity, where companies are usually small in size. In 2008, the funds managed/advised by Motilal Oswal Private Equity invested in Au Financiers, a vehicle-financing company based in Rajasthan. Au was a channel partner of HDFC Bank and was raising capital to grow assets on its own book.

- Q: In a capital-starved country like India, quality of the financial services business is never in doubt. Au’s quality of management was significantly honed by imbibing the best practices at HDFC Bank.

- G: Au’s asset base grew from Rs. 244 crores on Mar-09 to Rs. 4,855 crores by Mar-14 (82% CAGR). Over the same period, PAT grew from Rs. 2.3 crores to Rs. 101 crores (113% CAGR).

- L: Given the opportunity size, longevity is not a concern. Au now also offers SME loans and has a housing finance subsidiary.

- P: The initial investment was at a favourable P/B of 1.4x (Mar-09).

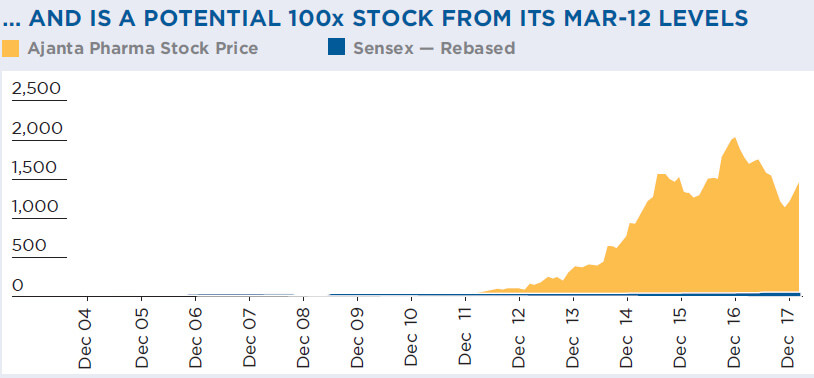

Ajanta Pharma exemplifies how a company, which passes the SQGLP test creates massive wealth.

Needless to add, the stock can potentially rise 100x from its Mar-12 levels. (It is already up 24x so far.)

SQGLP in private equity

Au has since got listed and is currently valued at over ` 18,000 crores, thus proving to be a 100x idea.

The “S” prefix

- The 19th Wealth Creation Study is the first after firming up of the QGLP investment philosophy.

- The study explicitly mentions that the framework for achieving 100x in equity investing is SQGLP. What this does is merely prefix the time-tested principles of QGLP with S, which stands for Size.

- The starting point to achieve 100x is that the company should be small and relatively unknown since sheer size mitigates high growth.

- All small companies which pass the QGLP litmus test are potential 100x stocks.